Source: Trajan - data as of 31/12/2023. The mention of certain investments does not constitute a recommendation to buy or sell the securities of the companies presented.

Market opportunity

In the European Union, countless small and medium-sized enterprises (SMEs) change ownership every year, with a profound impact on employment. Many close due to inefficient transitions, while a significant number of owners are approaching retirement. As few transitions are expected to remain within families, identifying suitable successors is essential.

Investment strategy

- Securing the transfer of SMEs, with a focus on the key success factor: the entrepreneur.

- Selection, financing and support of entrepreneurs in their search phase, the execution of the transaction and the follow-up of the investment:

1/ Demanding selection of talent and creation of a pool of entrepreneurs.

2/ Rigorous selection of investments with a focus on aligning interests with the seller.

Value creation

- Supporting SMEs in their structuring, transformation and development to reach

a critical size.

- Improved operational and financial performance: increased revenue and profitability.

- External growth strategy: market consolidation and international expansion.

Investment team

Team based in Paris and Brussels led by 3 partners.

Target allocation

Geography: France and Benelux.

Companies with a strong track record of performance, recurring revenue and a diverse customer base.

Enterprise value: €10 to €100 million.

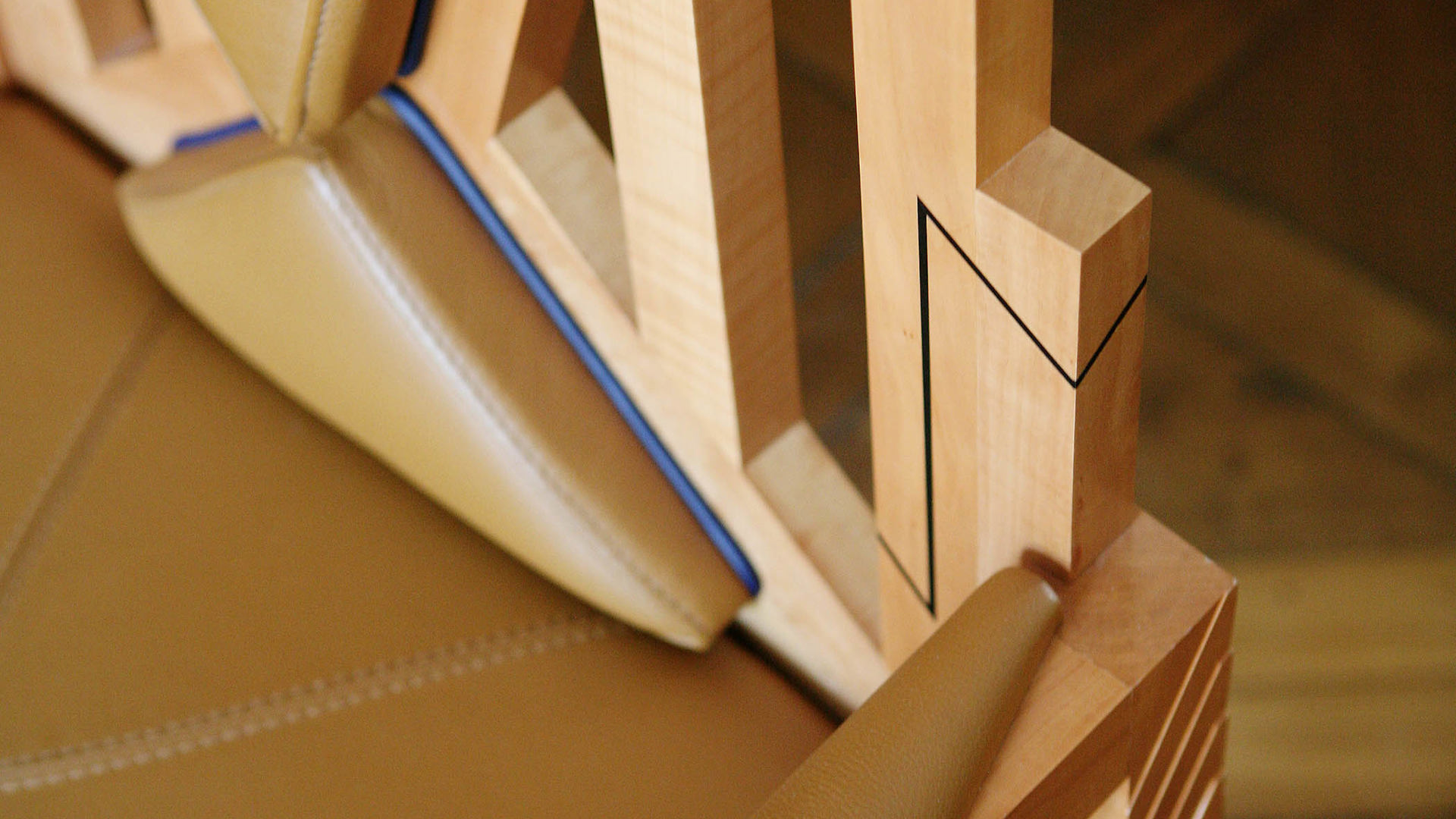

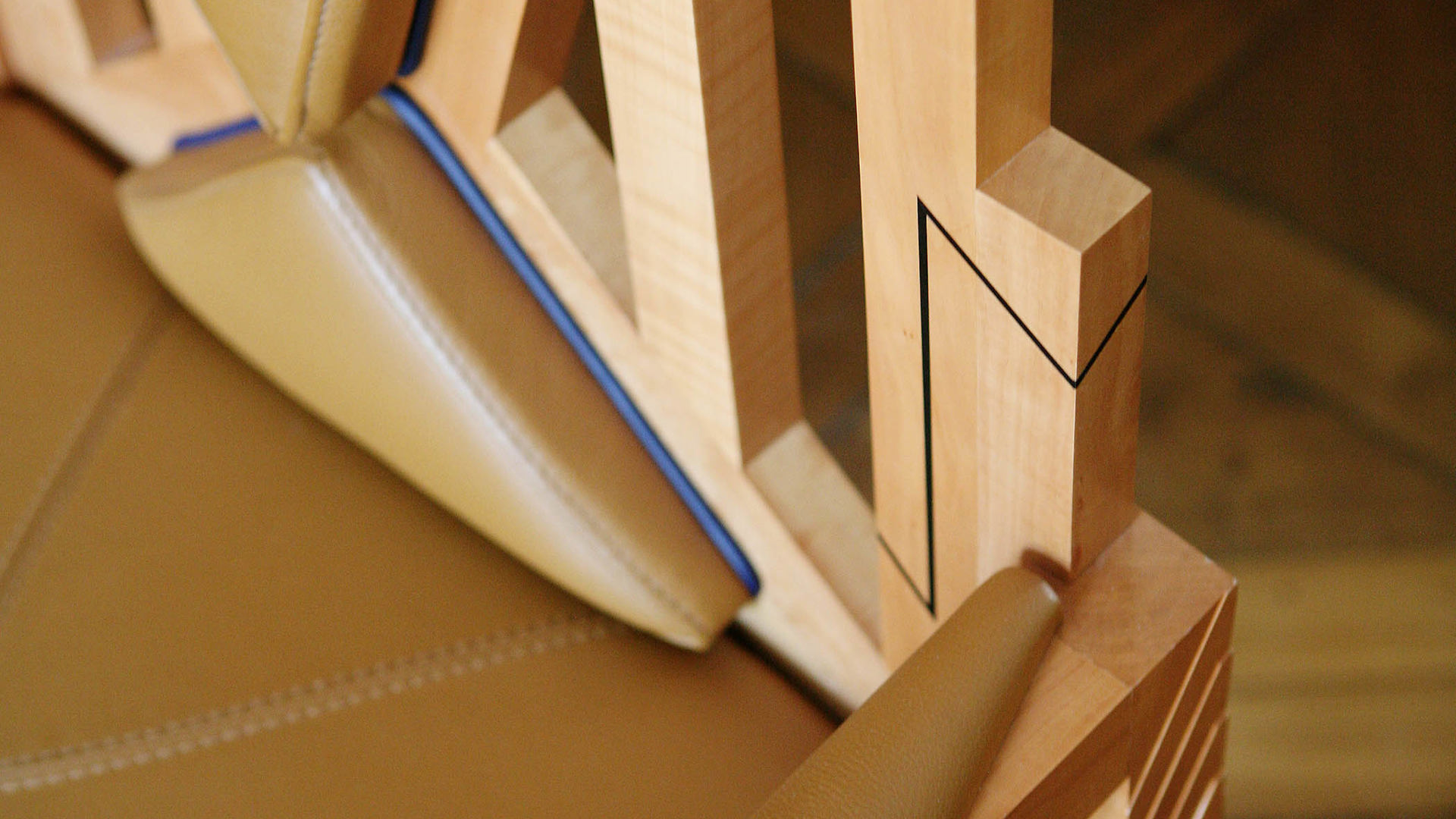

Robotisation solutions to make industrial production tools more efficient

Founded in 2008 and based in Finistère, AB Process Ingénierie offers its customers, mainly in the food industry, innovative solutions for the tailor-made and turnkey robotisation of their production lines.

Operation 1 (March 2020): transfer of an SME organized around an entrepreneur selected and supported by Trajan

Structuring of the management team with the arrival of a Director of Operations and an HR Director.

Development of the activity on key accounts.

Diversification into new sectors (logistics, pharmaceutical industry).

Deployment of a maintenance offer.

2 external growths acquisitions.

Transaction 2 (May 2023): sale and minority reinvestment

The competitive disposal process led to a pre-emptive offer and allowed the entrepreneur to substantially increase his share of the capital.

Source: Trajan - data as of 31/12/2023. The mention of certain investments does not constitute a recommendation to buy or sell the securities of the companies presented.