Interview with François-Xavier Vucekovic, CIO, Edmond de Rothschild Private Equity, Jean-François Marco, Partner, TIIC and Manuel Cary, Partner, Managing Director, TIIC.

In today’s uncertain and complex economic climate, infrastructure is an essential asset class. Their ability to withstand the ups and downs of economic cycles, combined with the predictability of their cash flows, makes them an undeniable attraction for investors seeking solid protection against inflation.

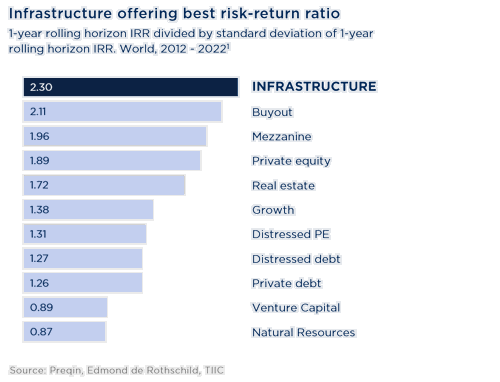

It is worth noting that infrastructure recorded the best risk-adjusted performance among alternative assets between 2012 and 2022. Each unit of risk, expressed as a percentage point of the standard deviation of returns, generated an average of 2.3 percentage points of return.

Redefining European infrastructures through sustainability objectives

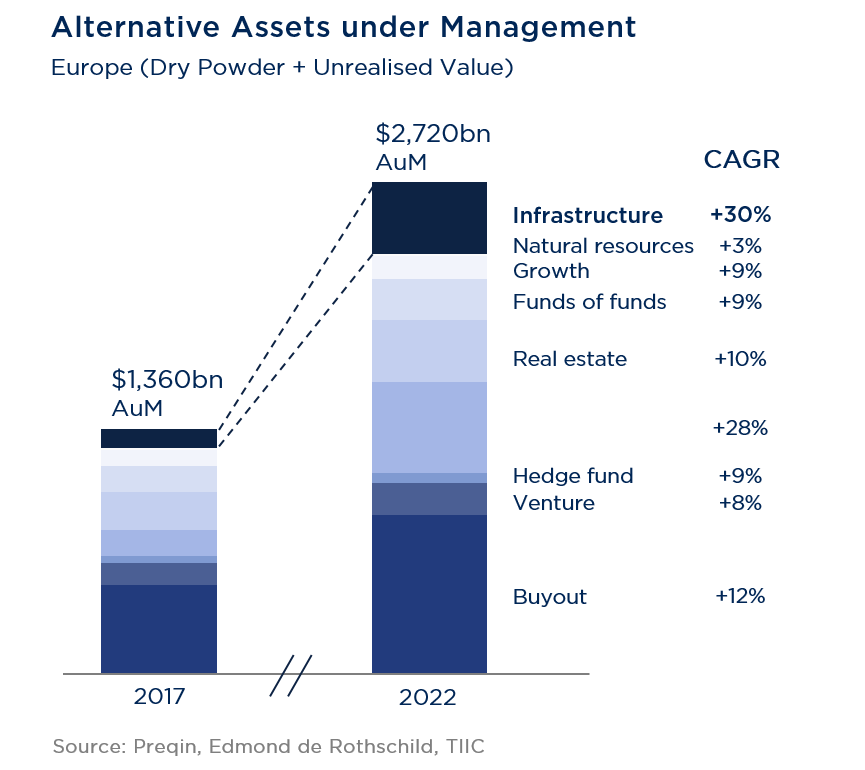

Infrastructure investments have enjoyed strong momentum over the past five years, growing twice as fast as all alternative assets on the European continent. In the face of various systemic shocks, such as the Covid-19 pandemic, the conflict in Ukraine and the intensification of economic rivalry between the USA and China, the appeal of infrastructure has grown. These events have underscored the resilience of infrastructure as a «safe haven», offering in many cases a protection against volatility and geopolitical uncertainty.

Today, macroeconomic, demographic and climatic challenges are shaking up Europe’s infrastructure system. The latter is forced to accelerate its modernization in order to adapt to three megatrends, offering investors opportunities for sustainable value creation.

The first of these trends is decarbonization: this requires an estimated annual investment of almost 1,000 billion euros to ensure the rapid transformation of mobility, energy and public infrastructure networks, and thus meet the ambitious climate targets set by the European Union for 2050.

Europe is also seeking to establish more localized supply chains and more autonomous energy networks. This trend, accentuated by the Covid-19 pandemic and escalating geopolitical tensions, means that infrastructures must be adapted and modified to meet these new demands.

Finally, the third megatrend driving demand for infrastructure is the rapid and increasing digitization and large-scale processing of data, which requires the creation of new digital infrastructures. For example, «smart cities»1 are using technology to optimize the way services are delivered, such as intelligent video and traffic systems or real-time information on air quality.

Towards increasing hybridization2 of infrastructures

These significant developments have contributed to the emergence of more decentralized, digitalized and service-based infrastructures. In our view, this hybridization is redefining the nature and essence of some traditional infrastructure projects, which are now integrating a variety of sectors, such as mobility, technology and green energy, and are better designed to address multi-dimensional issues ranging from climate change to new user habits.

Take mobility infrastructures, for example, which are evolving to incorporate intelligent transport systems. These sophisticated systems harness all kinds of connected devices, sensors and cameras for green energy recharging facilities - which are set to increase 20-fold by 20303. They also integrate «mobility as a service» platforms.

We need to move away from obsolete infrastructure models and develop systems that are both connected and sustainable, which we believe are essential if we are to effectively manage changes in consumer demand and achieve our climate objectives.

It is important to note, however, that these new opportunities, particularly those linked to connected infrastructures, bring with them new complexities, and by extension, new risks. Greenfield projects4, while offering the potential for high returns thanks to significant capital appreciation, require in-depth operational expertise and the ability to carry out concrete transformations.

The changing infrastructure landscape requires substantial funding. However, public investment has contracted, due to increasing budgetary constraints. Against this backdrop, private capital is needed more than ever to make up the shortfall and help finance infrastructure conversion.

Seizing mid-cap market opportunities to finance infrastructure transformation

The mid-cap segment is a fertile ground for financing infrastructure transformation and modernization. Less subject to the stiff competition from large-caps5, this market offers excellent prospects thanks to attractive entry prices, combining quality and accessibility. The market is brimming with opportunities, and stands out for its strong flow of medium-sized transactions (under €1 billion). By 2022, they accounted for 88% of the total volume in Europe.

Over the past five years, entry multiples have been particularly attractive in the mid-market, and even more so in the transport, energy and social infrastructure sub-sectors.

It’s also crucial to emphasize that medium-sized projects respond directly to consumer expectations and are at the very heart of economic growth and the energy transition.

We also favor the European infrastructure market, which is dynamic, large and diversified, and which has historically generated better risk-adjusted returns than unlisted infrastructure in Asia-Pacific or America.

So, making the European mid-market6 our area of choice is not just a question of returns, it’s first and foremost a resolutely forward-looking vision. In our view, it’s a question of investing early to transform infrastructures and bridge the current financing gap.

This market also requires significant local knowledge and experience. We believe that an approach focused on risk management, backed by operational investment expertise, is essential. Management teams need to be able to support company management, both financially and operationally. This includes setting up solidly structured partnerships and regular exchanges with company directors.

This active strategy, coupled with an operational approach, enables us to exert concrete influence and take advantage of the many sources of value creation in this market.

Infrastructure represents a key asset class for successfully navigating the current economic environment. To take advantage of the opportunities and trends currently emerging in this constantly evolving market, it is essential to have an active strategy, based on a detailed understanding of the trends at work, the current constraints, but also the innovations likely to transform the infrastructure landscape in the years to come, especially as investments made today will undoubtedly have an impact on Europe’s economy and energy transition in the medium and long term.

1 Smart cities refer to urban policies that use information and communication technologies (ICTs) to accelerate a city’s ecological transition while enhancing its international competitiveness.

2 Hybridization refers to the convergence of three structural trends: decarbonization, regionalization and digitalization.

3 «How much investment do we need to reach net zero?», Lenaerts, K., S. Tagliapietra& G.B. Wolff, Bruegel, 2021.

4 A “greenfield” project is a project in a previously undeveloped area.

5 A company is classified as “large cap” if its market capitalization exceeds 10 billion euros.

6 The mid-cap (middle capitalization) market is made up of mid-cap companies with market capitalizations of between €2 and €10 billion.

DISCLAIMER

This is a marketing communication.

September 2024.

This document is issued by the Edmond de Rothschild Group. It has no contractual. It is intended for information purposes only.

This document may not be communicated to persons located in jurisdictions which it would constitute a recommendation, an offer of products or services or a solicitation and whose communication could, as a result, contravene applicable legal and regulatory provisions. This material has not been reviewed or approved by any regulator in any jurisdiction.

The figures, comments, opinions and/or analyses contained in this document reflect the Edmond de Rothschild Group’s view of market trends based on its expertise, economic analyses and the information in its possession at the date of preparation of this document, and are subject to change at any time without notice. They may no longer be accurate or relevant at the time of publication, particularly in view of the date of preparation of this document or market developments.

The sole purpose of this document is to provide general and preliminary information to those who consult it, and it should not be used as the basis for any investment, divestment or holding decision. Under no circumstances may the Edmond de Rothschild Group be held liable for any investment, divestment or holding decision taken on the basis of the aforementioned comments and analyses.

The Edmond de Rothschild Group therefore recommends that all investors obtain the various regulatory descriptions of each financial product before investing, in order to analyze the associated risks and form their own opinion independently of the Edmond de Rothschild Group. It is recommended to obtain independent advice from specialized professionals before entering into any transaction based on the information contained in this document, in order to ensure that the investment is suitable for the investor’s financial and tax situation.

Past performance and volatility are not indicative of future performance and future performance and volatility, are not constant over time and may be independently affected by changes in exchange rates.

Source of information: unless otherwise indicated, the sources used in this document are those of the Edmond de Rothschild Group.

This document and its contents may not be reproduced or used in whole or in part without the permission of the Edmond de Rothschild Group.

Copyright © Edmond de Rothschild Group - All rights reserved.

GLOBAL DISTRIBUTOR and MANAGEMENT COMPANY

EDMOND DE ROTHSCHILD ASSET MANAGEMENT (FRANCE)

47 rue du Faubourg Saint-Honoré / FR - 75401 Paris Cedex 08

Public limited company with a Management Board and Supervisory Board and a capital of 11,033,769 euros

AMF approval number GP 04000015 - 332.652.536 R.C.S. Paris