Since the end of October 2023, the MSCI WORLD has jumped more than 20% and smashed through records1. Fourth-quarter results were on the whole upbeat but they can hardly justify such extraordinary returns. We usually see such gains when the market is anticipating the end of a recession or during phases like the internet bubble in 1995-2000. As we are not emerging from a recession, it is of course tempting to draw parallels between the AI surge and the internet bubble. So are we in a bubble?

- The share price of AI star NVIDIA looks dangerously parabolic but its fourth-quarter earnings were extraordinary. The AI craze and the internet bubble have one thing in common: massive earnings growth expectations. But the difference today is that at least there is already some incipient earnings momentum to justify the enthusiasm. Nvidia is trading around a 2024 PE of 362, a demanding multiple but not an impossible target for a high-growth stock.

- And the exuberance over certain stocks is much more selective than before 2000. Even among the “Magnificent 7”, returns have varied considerably to the point where we have to wonder whether they are not already a part of history. For example, even Tesla has fallen sharply.

- At the end of October, on the eve of the market rally, investors were not ruling out one last Fed hike. Today, the question is - when the Fed will start cutting? The market’s upward move is also in part linked to the central bank pivot. The rate-cutting programme might be more measured than initially thought but a downward move would not seem to be in question.

So although we cannot extrapolate this powerful market rally, it is certainly not a bubble. But is a downward market shift due?

On the one hand, the economic environment is good for risk assets. The US economy keeps showing surprising vigour but the chances of the labour market returning to more normal conditions are still good. The latest data even suggest business activity will soon start to normalise. Europe's economy seems to be flirting less with recession while China’s economy is growing less but is warding off a collapse thanks to budgetary tweaking. Central bank surveys of commercial banks call for a gradual easing of lending conditions. Such a move would be welcome as bank lending to the economy is slightly down. Following disappointing indicators in January in both the US and Europe, the main risk we need to focus on today is a pick up in inflation.

On the other hand, liquidity will be less abundant. Quantitative Tightening (QT) is ongoing and the Fed’s Overnight Reverse Repo Facility (ON RRP), where banks deposit cash, is rapidly running low, seriously reducing its capacity to supply liquidity. As a result, it will soon be unable to offset some of QT’s restrictive impact on liquidity.

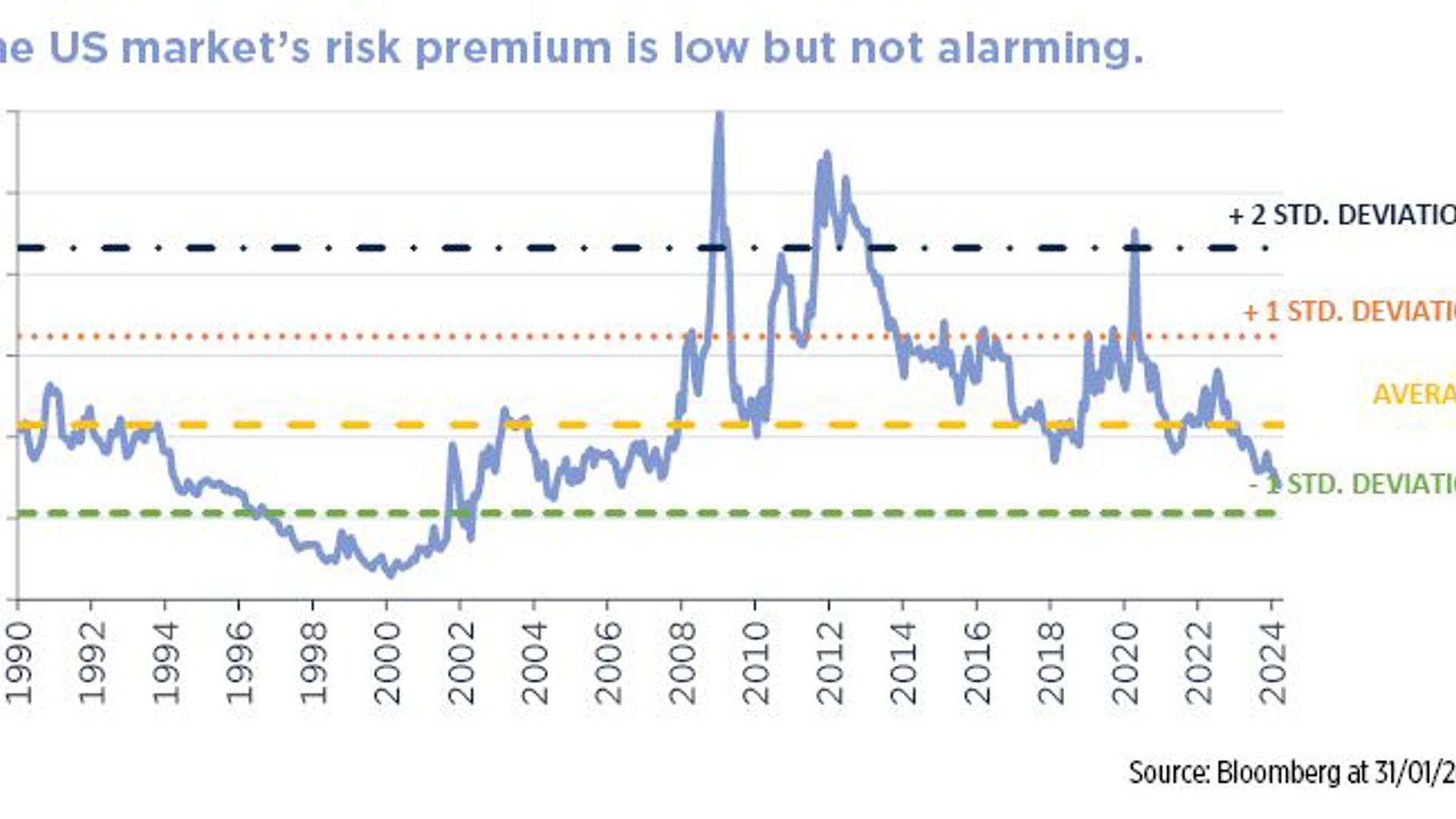

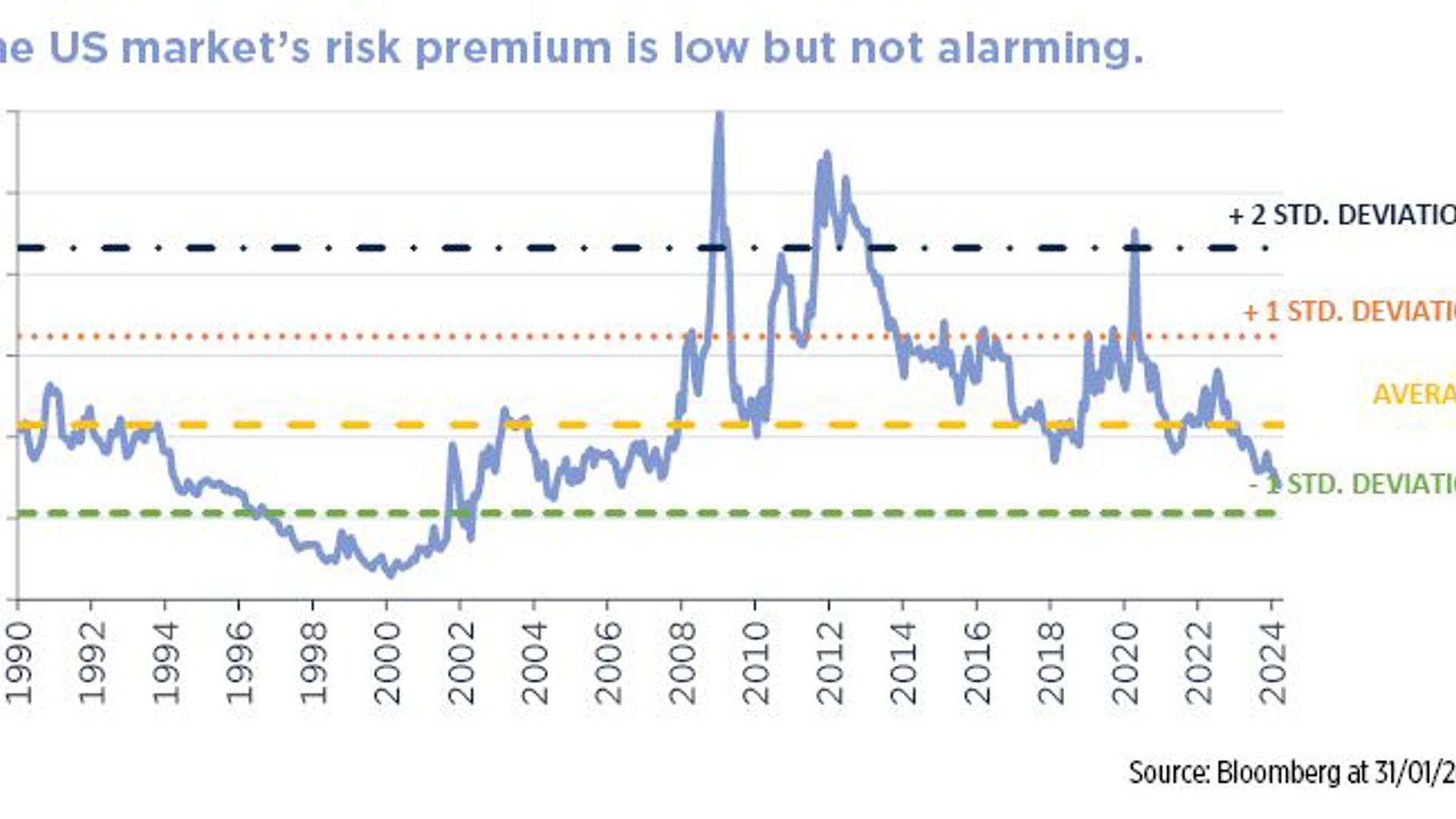

The US market's risk premium has fallen sharply, albeit to levels which are not particularly worrying; all it shows is that long term outperformance of bond markets is likely to be below average but with no obvious short term indications.

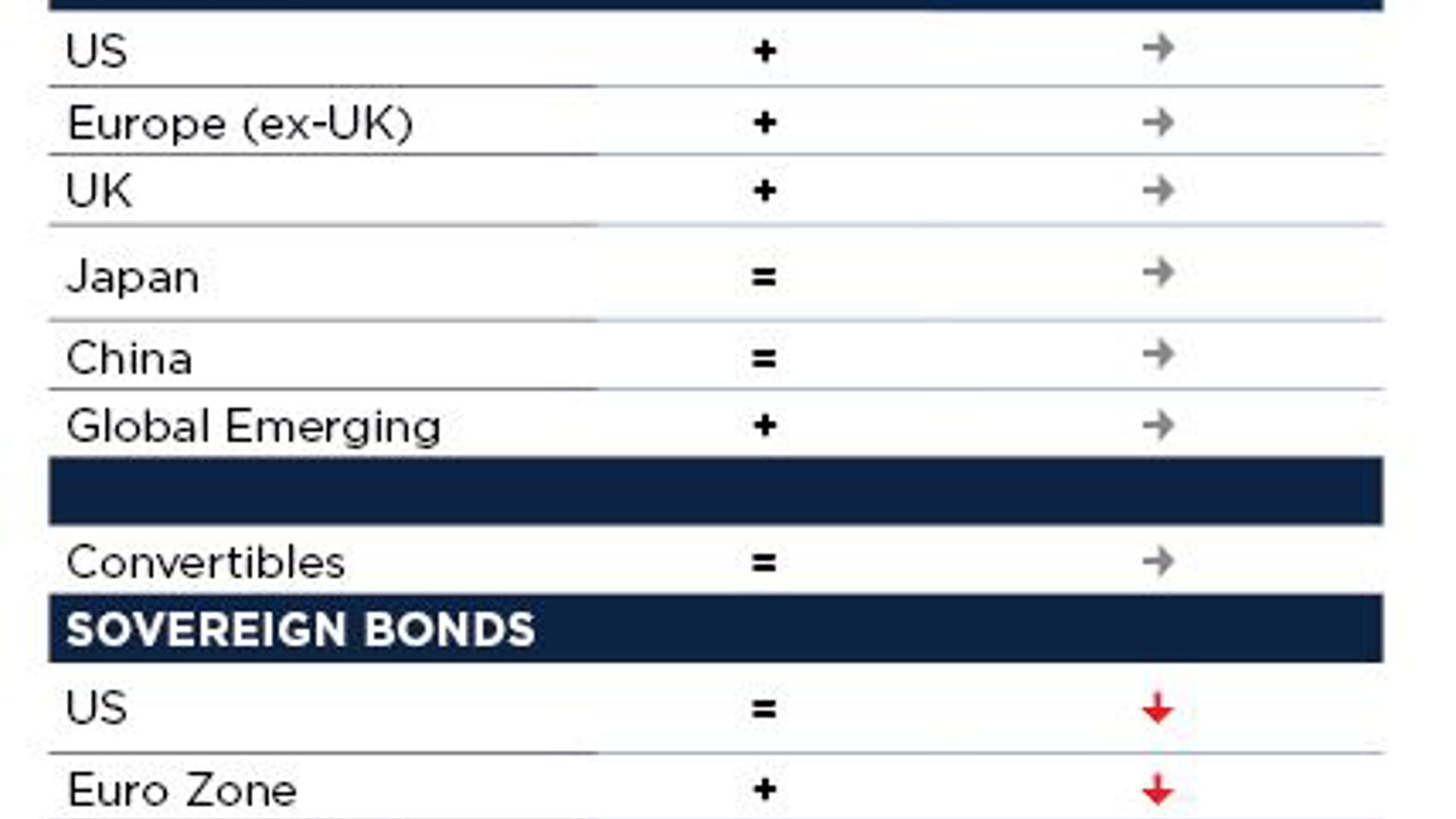

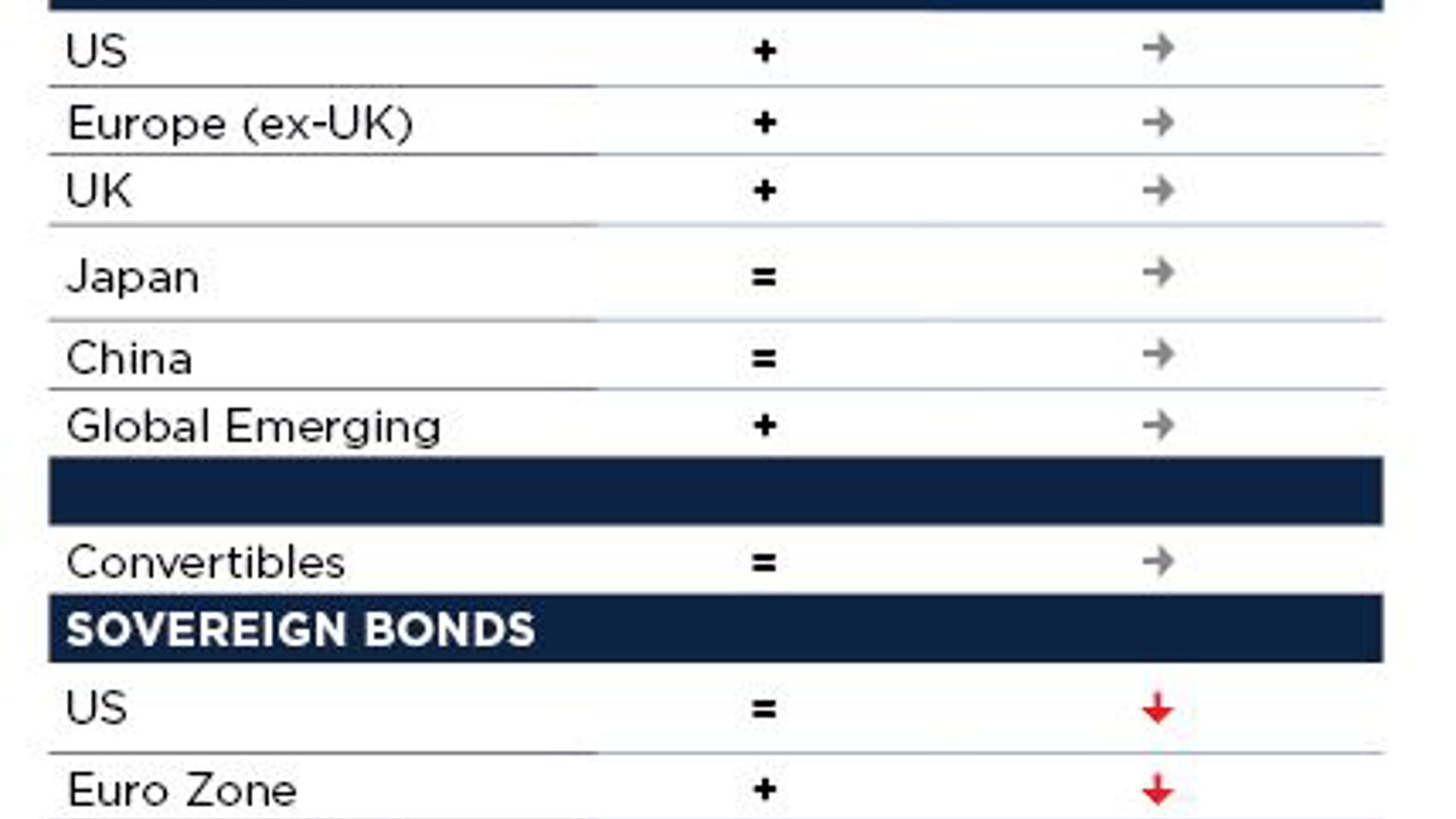

We are maintaining our neutral weighting on equity markets and are still overweight fixed income. We have, however, reduced our exposure to US Treasuries as we think there is more risk of inflation picking up there than in Europe.

1 MSCI World NR in USD from 31/10/2023 to 07/03/2024: +23.1%. 10 year performance: 141.14% or an annualised 9.19%.

2 PE : Price Earnings. Source Bloomberg at 07/03/2024.

Key points

- The MSCI World smashed through records.

- Although we cannot extrapolate this powerful market rally, it is certainly not a bubble.

- The economic environment is good for risk assets but liquidity will be less abundant.

- We are maintaining our neutral weighting on equity markets and are still overweight fixed income.