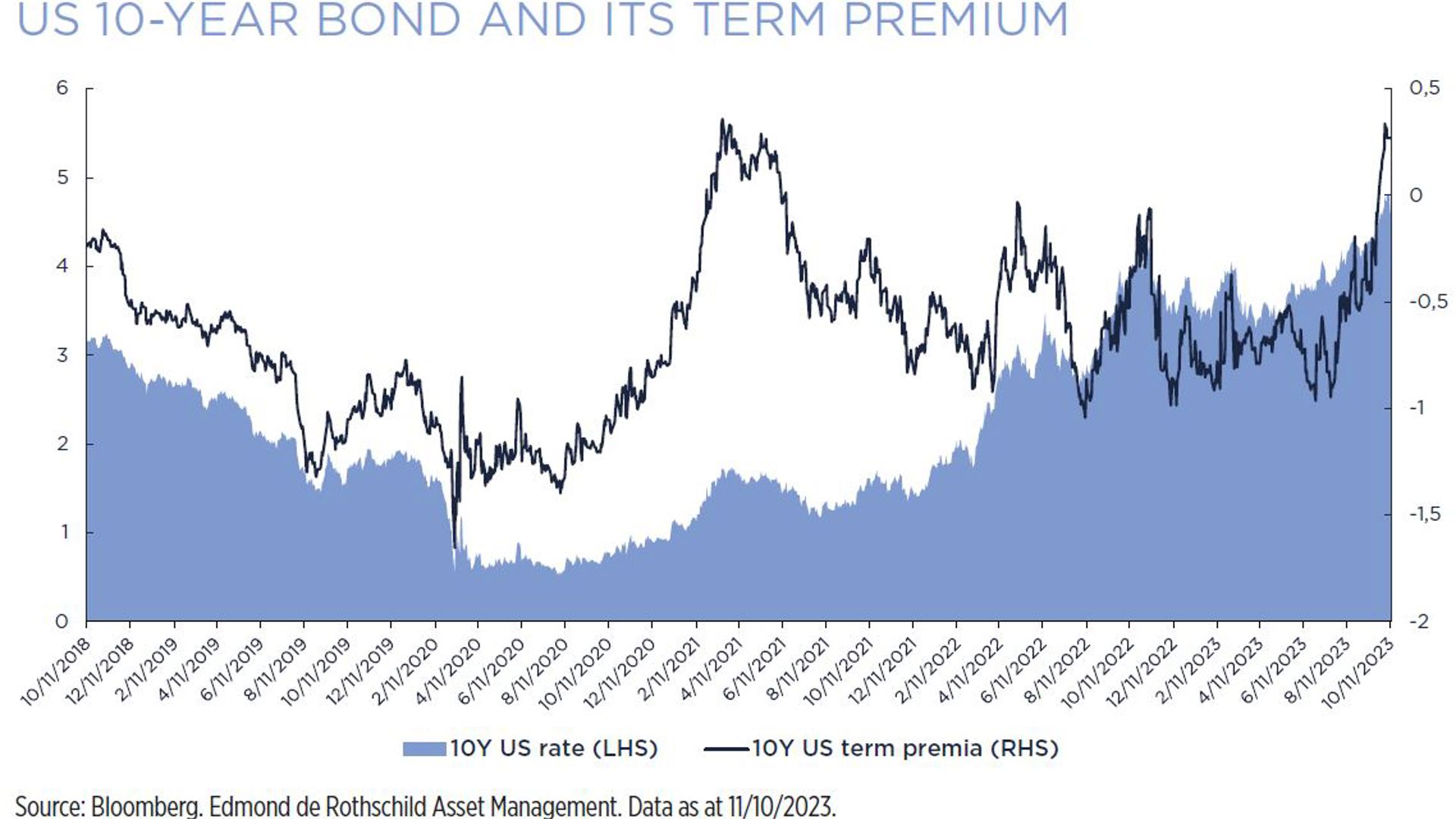

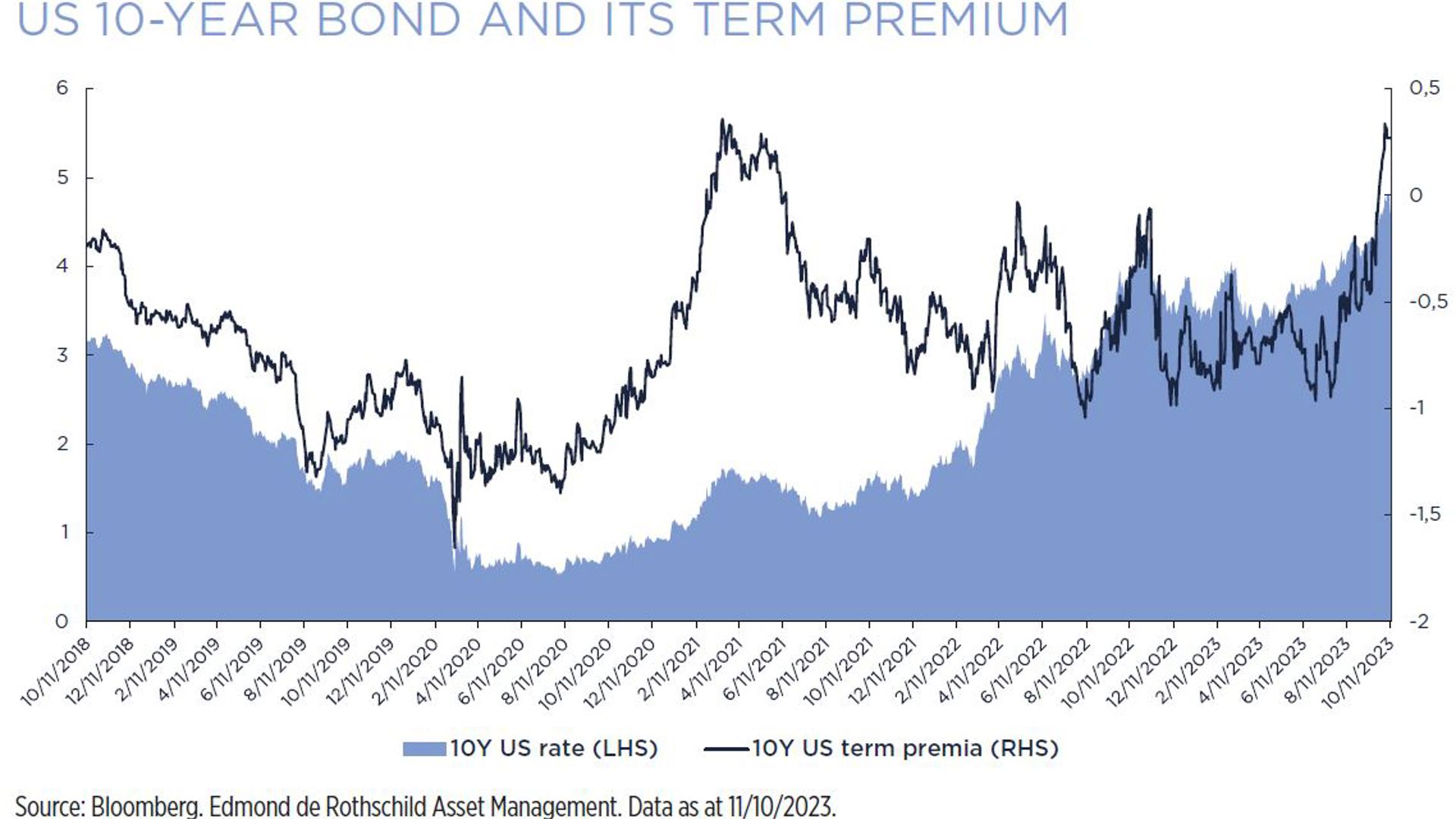

Bond markets have been falling since the beginning of September, sending yields on 10-year US Treasuries and the equivalent German Bund up by 60bp and 40bp, respectively. The move higher has been accompanied by significant yield curve steepening.

The tension is not due to rising oil prices as the inflation breakeven point has only risen by a few basis points. Nor is it because markets are expecting central banks to stick with high interest rates for longer as even the 5-year and 10-year yield curve has steepened rather than flattened. The real cause is the rise in the term premium, an unobservable variable but one which is subject to various estimation methods. It is geared to so many factors that short term movements can be hard to understand and even harder to anticipate.

By making the long end of the yield curve unappealing, the sheer extent of yield curve inversion has played a part. There are also two opposing schools of thought which try to explain the shift: the first holds that markets now accept that central banks will keep rates at today's elevated levels, or even a little higher, the second that persistently high government deficits (around 8% of GDP in the US, for example) show no signs of falling back. To be clear, neither explanation is totally satisfactory: term premium movements are usually unrelated to monetary policy expectations and the idea that higher long bond yields are due to a crisis brewing over US deficit funding is contradicted by the dollar’s strong performance.

So we are facing an unknown factor in this recent move but bond markets will surely return to normal as the end of severe US yield curve inversion, ongoing disinflation and the upcoming soft landing come fully into play. At the same time, another factor in favour of markets stabilising comes from some Fed officials openly arguing, even amid persistent labour market strength, that higher long bond yields reduce the need to press on with monetary tightening. And then there is the war in Israel, another reason to buy safe-haven government bonds despite upward pressure on oil prices. All of this explains why we continue to be overweight bonds.

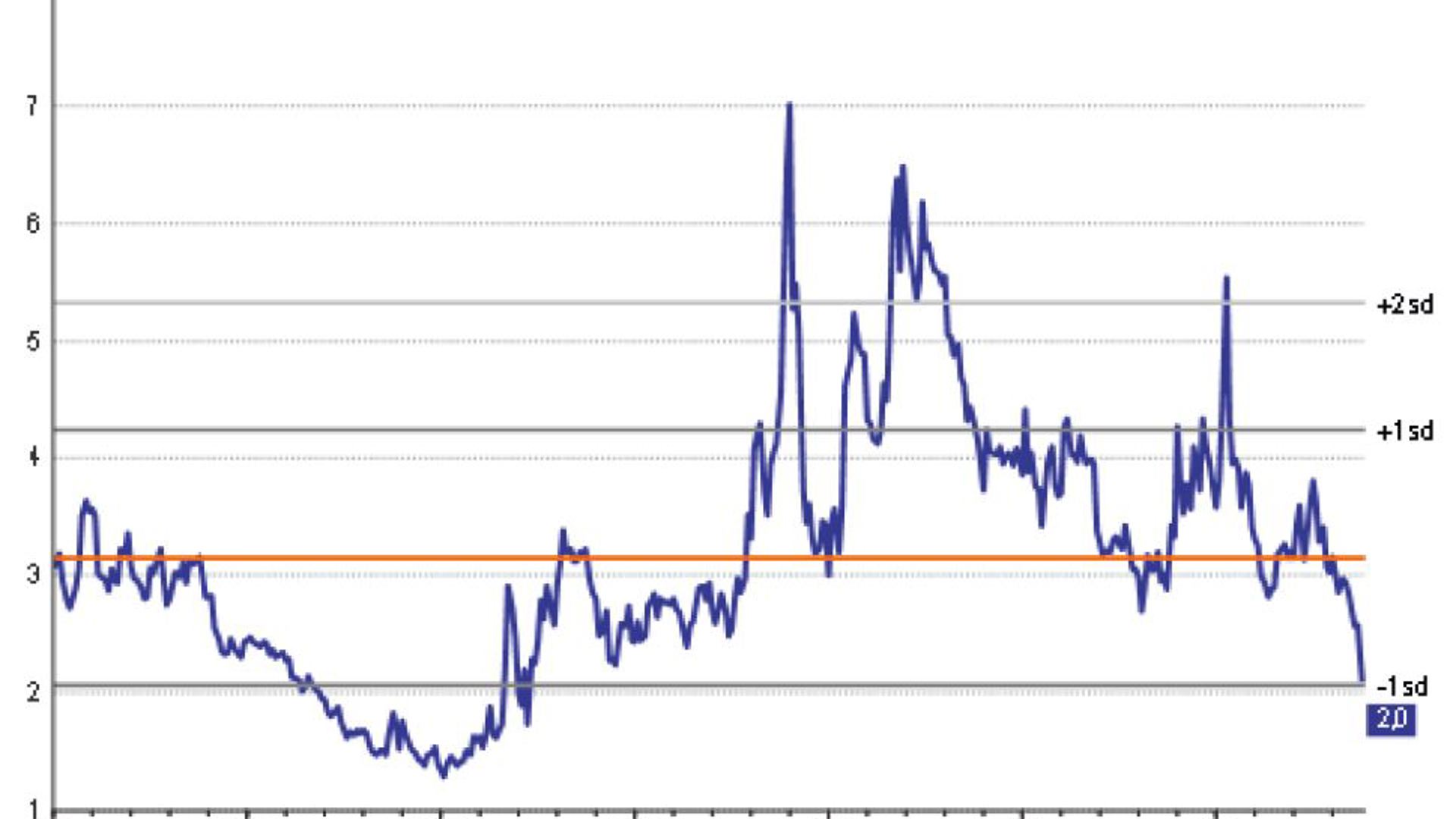

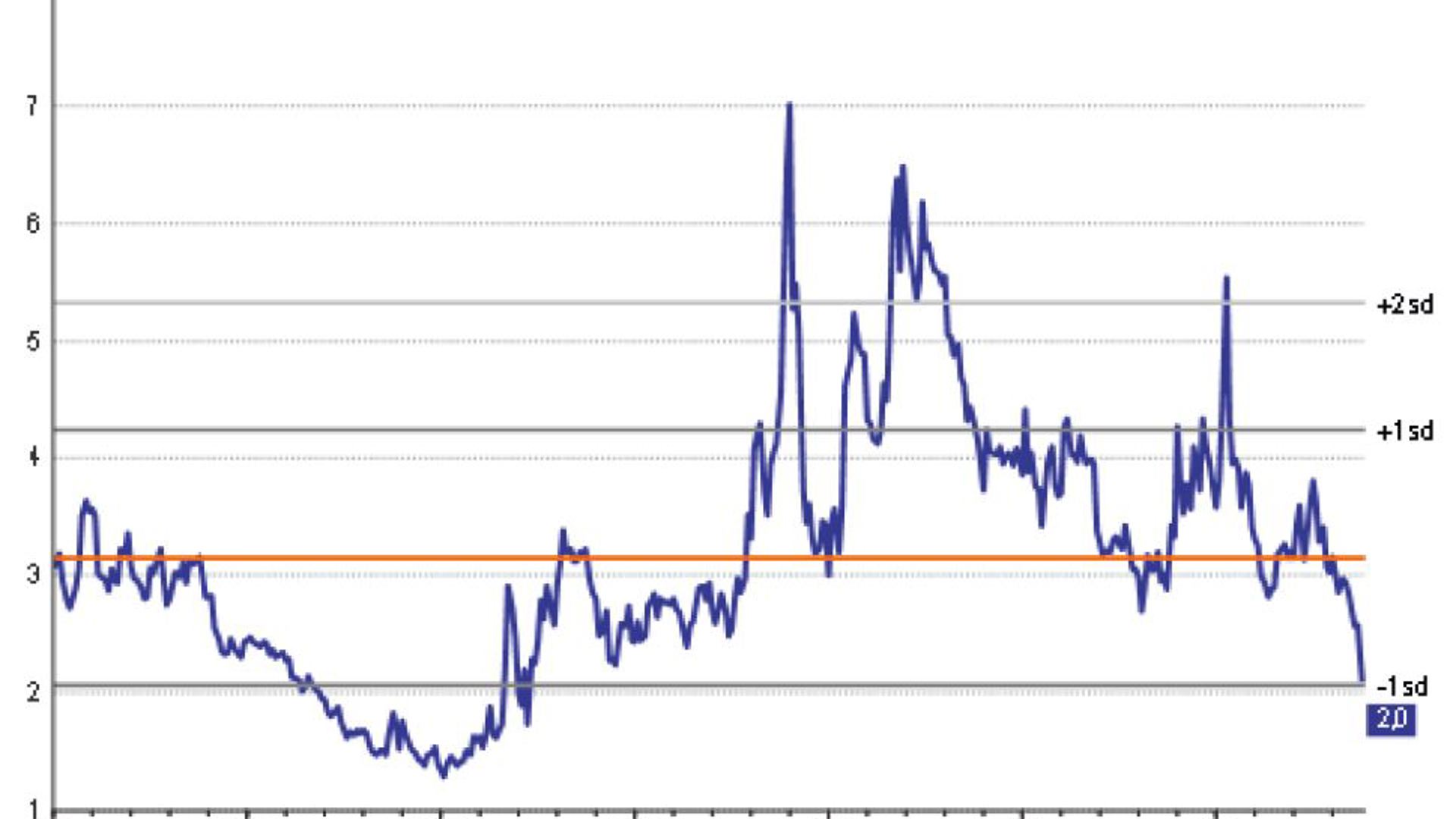

Higher long term yields have crushed risk premiums

As we approach the third quarter earnings season, it is clear that not only have higher long term rates crushed risk premiums, leaving equity markets with little upside compared to bonds, but they have not yet spread throughout the economy.

A recent survey from the Federal Reserve1 based on a very wide sample group shows that around 37% of companies (most likely non-listed SMEs essentially) are in financial distress. It is reckoned that bank loan interest for a US SME is roughly 9% while a 30-year mortgage costs almost 8%. Average credit card interest is 23%. Higher rates feed through to economies in very different ways but always slowly. We believe these factors could lead to instability. For example, when the US slowdown starts, companies will have to deal with a drop in sales while their financial costs will continue to rise. The yield on 10-year bonds has risen by almost 1% since the beginning of summer so we cannot rule out other accidents of the Silicon Valley Bank type.

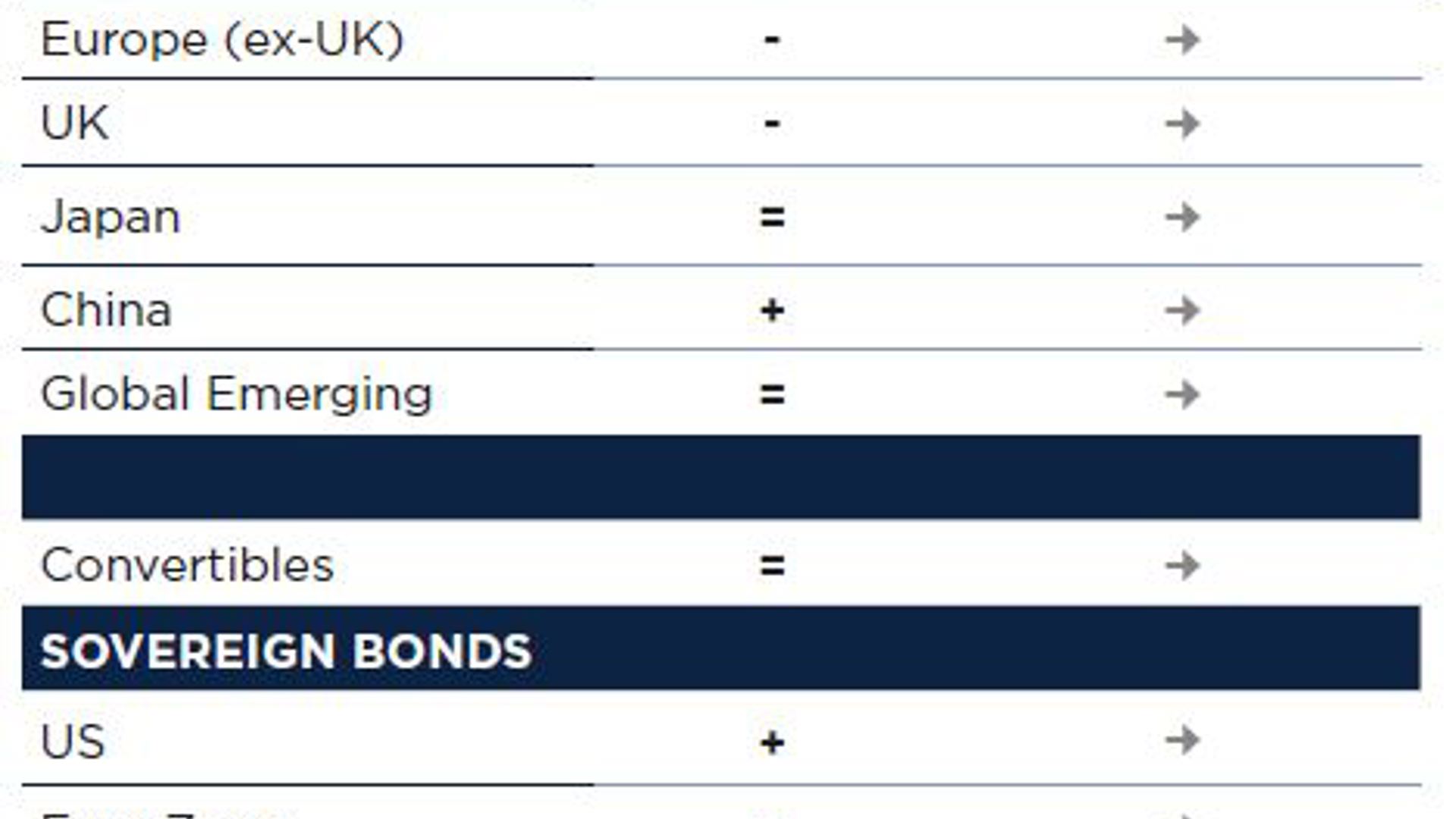

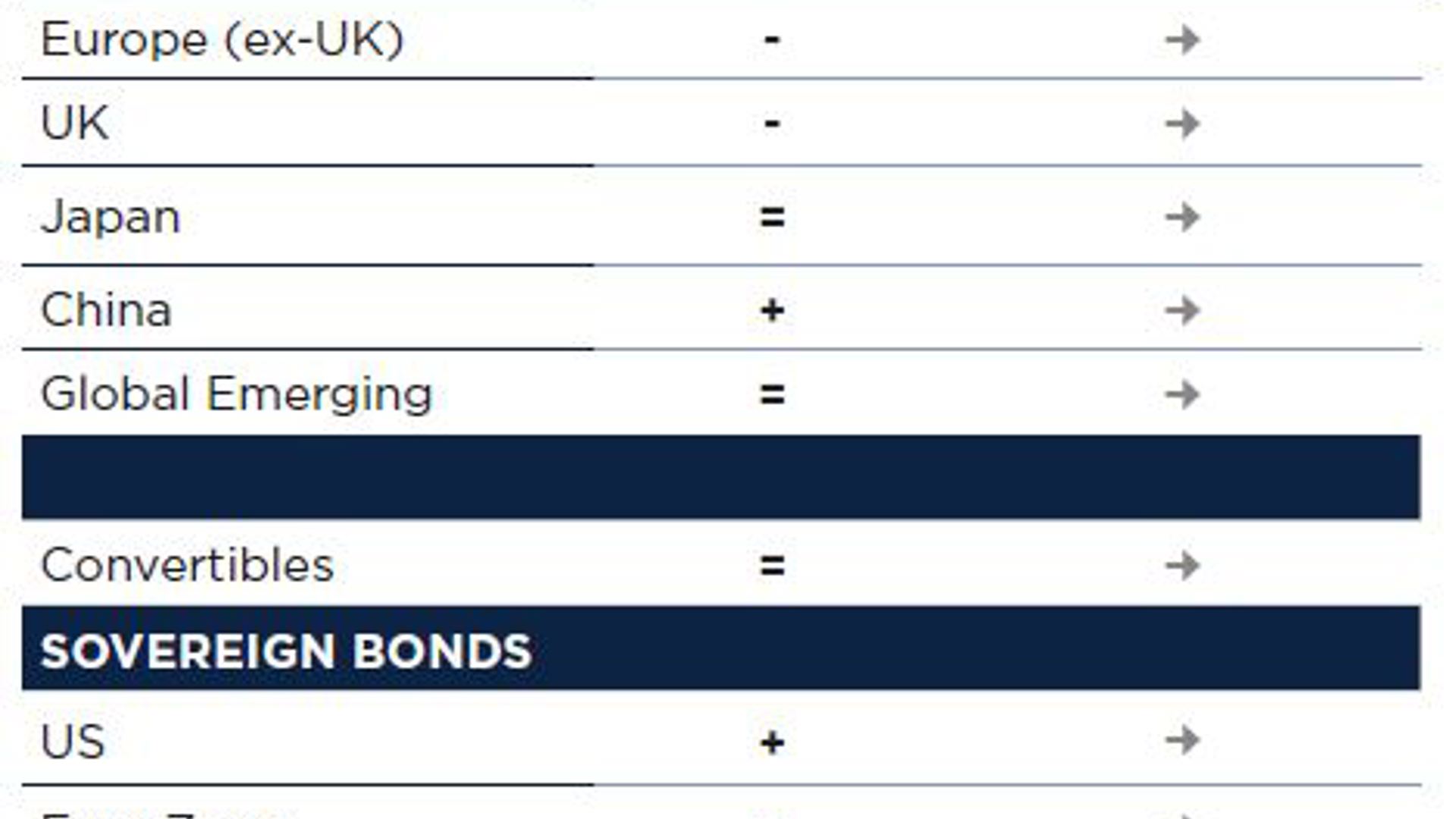

All these factors have led us to maintain our rather cautious stance on asset allocation. We are still overweight bonds and slightly underweight equities. Recent events in the Middle East and the risk of the conflict spreading are another reason to be cautious. After the tech sector boom, we are now focusing on the Big Data theme to cash in on the artificial intelligence revolution's spread to the wider economy. We also like healthcare. The sector has lagged but will benefit from numerous therapeutic breakthroughs and it generally performs well in more testing economic conditions. In fixed income, we continue to focus on European investment grade debt and good quality high yield bonds.

1. Ander Perrer-Ovine & Yannick Timmer: Distressed firms and the large effects of monetary policy tightenings. June 2023, Fed Economic Research.

Key points

- We continue to prefer bonds to equities

- We are focusing on European investment grade debt and good quality high yield bonds

- We like Big Data and healthcare