Article written by Roxana Mitroi, Multi-Asset & Overlay Portfolio Manager.

One thing is sure about financial markets, no day is the same!

Macroeconomic surprises, monetary policy announcements, investors’ hesitation between soft-landing and recession or unexpected events such as the collapse of Silicon Valley Bank (SVB) and the takeover of Credit Suisse by UBS rattled investors in 2023. Oddly enough, FX markets proved resilient. But for how long?

In a world where interest rates are expected to stay “higher for longer”, we believe it is the right time to consider the impact the currency risk has on corporate operations.

Investors often assess risks relative to a specific asset class. But investment risks are not mutually exclusive. For Treasurers today, interest rate risk is high on the agenda. In contrast, the low volatility seen on major currency markets this year may have caused Treasurers to put currency risk on the back burner.

Should Treasurers implement an FX hedging strategy today?

In short, we believe it is best to be prepared rather than to play catchup because markets are difficult –if not impossible - to predict.

This year, FX volatility was subdued despite the many events that occurred, so investors would be forgiven if they neglected currency risks. It is also important to note that the past years account for an unprecedented accommodative monetary policies, which compressed the FX volatilities. Now, with different monetary policies in place, what will happen when volatility soars? Surely it is more prudent to prepare for the inevitable and implement a hedging strategy rather than wait until it’s too late.

Crucially, hedging costs also increase when FX volatility rises. Hedging costs are directly influenced by central bankers’ pace of monetary policy deployment. While the trajectories of interest rate hikes on either side of the Atlantic were unanimous, the pace of these hikes diverged. In 2022, the annual cost to hedge the USD for a EUR-based investor almost reached 3% (based on the interest rate differential) as the Fed hiked rates faster than the ECB did.

Today, the differential has closed to some extent, but one would expect a similar phenomenon to reoccur as the respective central banks loosen monetary policies according to economic conditions. So far, the US economy seems more resilient while in Europe, the situation is more fragile. This suggests the differential may re-emerge.

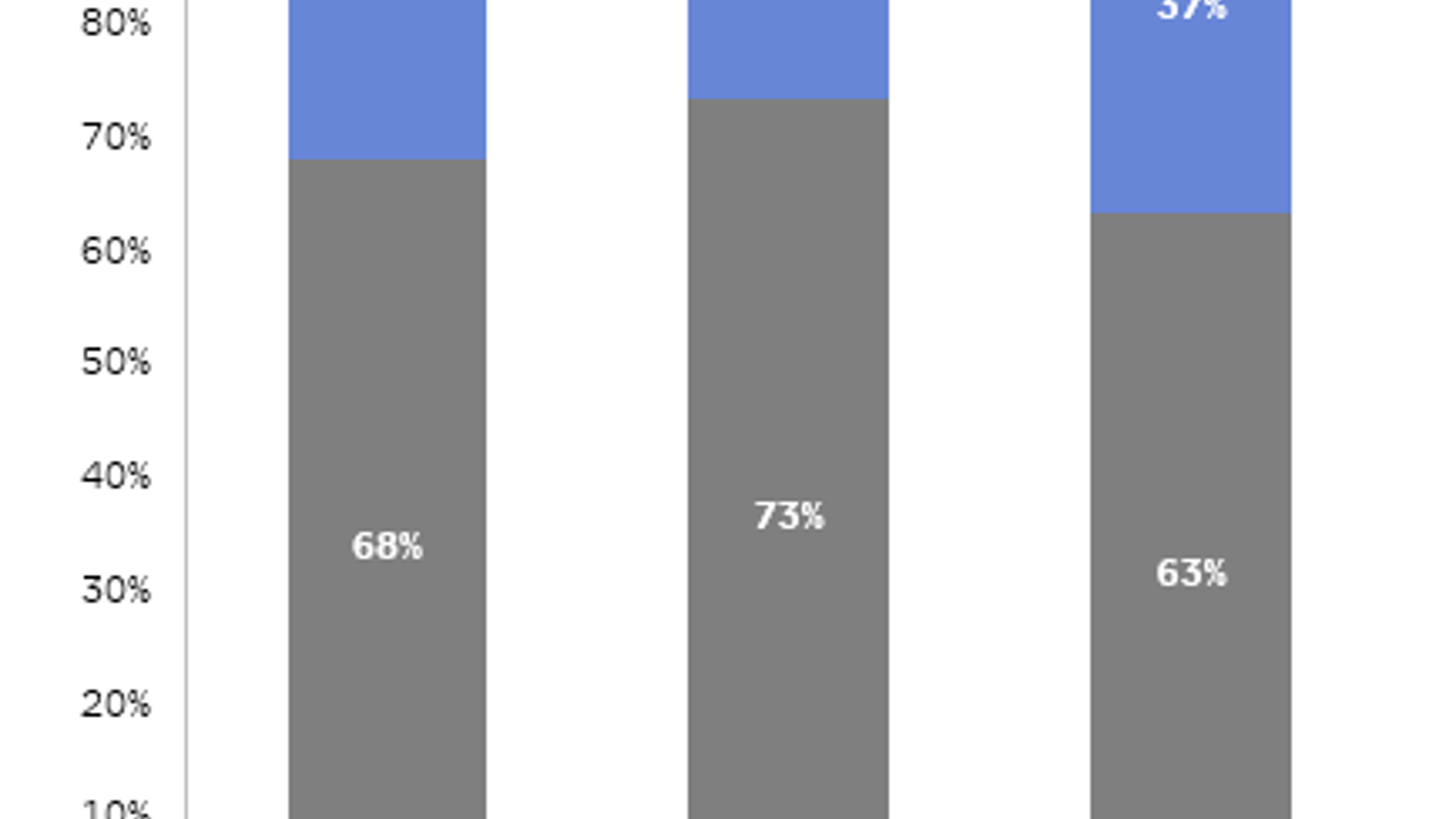

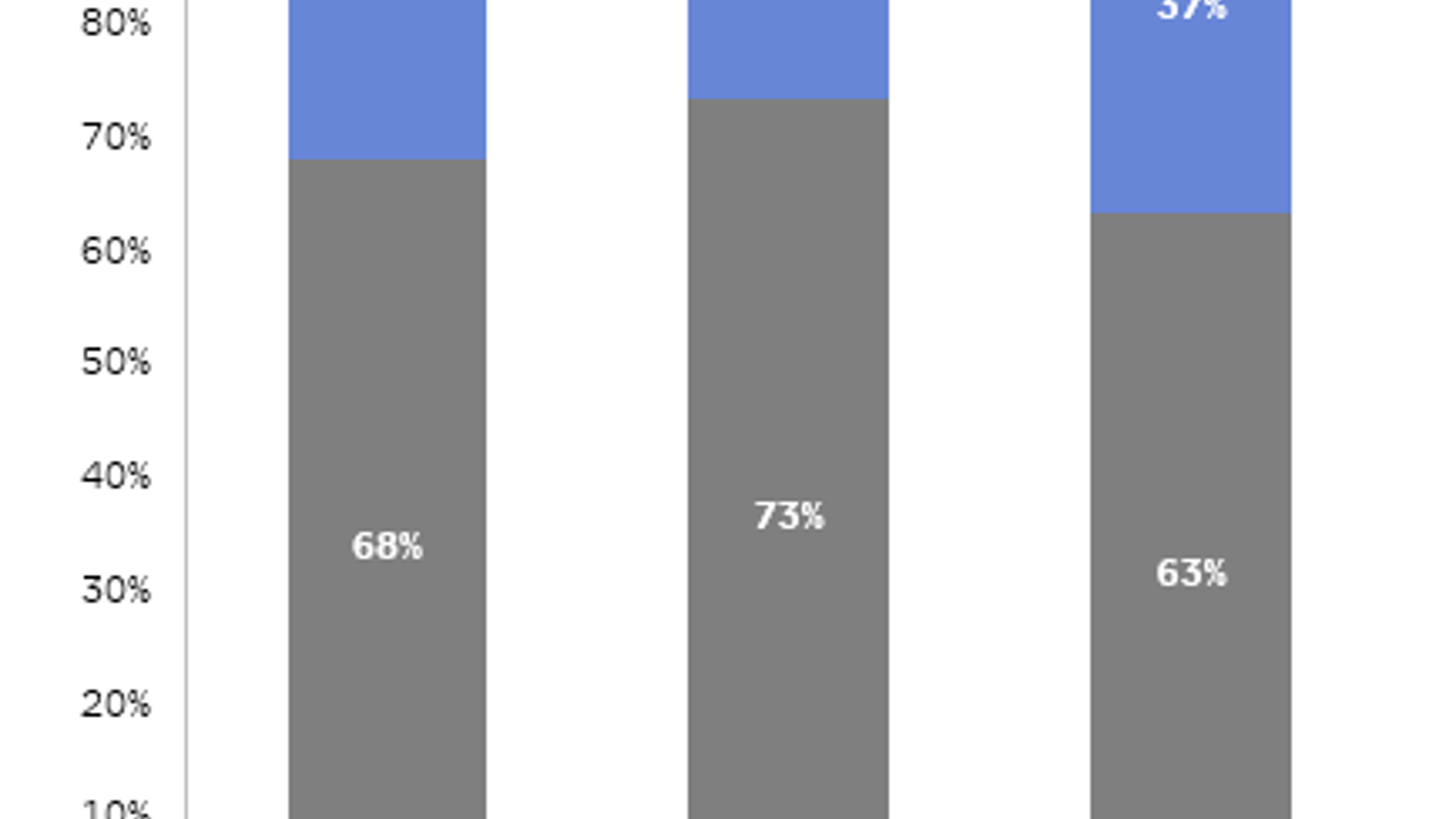

From an investment portfolio perspective, the impact of currency risk is worryingly high. In a portfolio invested 50/50 in bonds and equities since 1987, currency risk accounts for roughly a third or portfolio risk. And this remains true for an US, European, or Japanese portfolio (fig.1.).

Source Bloomberg – data: from 01.01.1987 to 31.12.2022. Equities: S&P500; FTSE100; Nikkei225 / Bonds: Index Citi Bond US, UK & JP. Risk is expressed as the total variance of a 50% stock & 50% bond portfolio, using the S&P500, FTSE 100, & Nikkei 225.

What can Treasurers do to protect themselves against currency risks?

Treasurers have two options: Passive hedging or Active Hedging.

Passive Hedging cancels FX movements by locking in FX rates. However, the cost of hedging may be significant and could impact a corporates’ liquidity and P&L statement.

Furthermore, Treasurers choosing a passive hedging strategy will not benefit from any increase in the investment currency and may incur high cash flows from keeping a permanent hedge, which can disturb the daily operations of the company.

An active hedging partly tackles these issues because the degree of protection (the hedge ratio) against currency moves dynamically adjusts to prevailing currency market.

How do we reduce the cost of hedging?

With passive hedging, the cost can be improved in two ways. The first is to ensure we have the best possible execution. This includes a thorough selection and monitoring of brokers used for execution as well as access to liquidity. The second is to monitor continuously the cost of hedging over different maturities in order to optimise the maturity of the contracts implemented. Generally, this reduces the cost by a little over 10 basis points per year.

With active hedging, we adjust the hedge ratio to currency movements using quantitative models that incorporate a variety of metrics (trends, external factors, volatility, carry trade, valuations). Using this dynamic hedging strategy, the underlying position may benefit from upward movements in the investment currency which helps reduces hedging costs when protection is needed less. In parallel, as the position is not fully hedged at all times, the cash flows related to hedging are also lower.

Why choose an external manager to manage currency risk?

Currency hedging is a resource-intensive activity, best delegated to a team of currency specialists. An external manager would allow Treasurers to allocate internal resources to the company’s core business. However, we believe there are several key aspects to consider when choosing an external FX hedging provider.

Treasurers should select an experienced provider who is able to offer a complete tailor-made service going well beyond execution. This includes offering a currency risk exposure assessment to design the most suitable hedging policy, monitored for adjustments over time. In addition, the provider should be able to apply cost effective decisions to optimise hedging costs, and ultimately provide fully transparent reporting on performance, transactions, cash flows and trade operations within a given regulatory framework.

The provider should also have the infrastructure to minimize operational risks, such as dedicated currency hedging tools, access to liquidity providers, best execution monitoring standards – including the ability to obtain competitive pricing, and so on.

Finally, Treasurers should ensure the provider has no conflicts of interest (ie: no proprietary trading or trading in favour of its own bank).

To conclude, hedging currency risk is a must for any business exposed to foreign currencies. Solutions exist, but need to be tailored to business’ specific needs – be it to reduce cash flows or hedging costs, tolerance to risk, and so on. So delegating the complexities of this activity to a specialist is the most rational approach.

Edmond de Rothschild Asset Management has 25 years' experience in overlay management. Its team of 8 experienced managers offers a variety of investment solutions to manage specific market risks, whether in currencies, indices or precious metals.

DISCLAIMER

This is a marketing communication. October 2023. This document is issued by the Edmond de Rothschild Group. It has no contractual value and is designed for information purposes only. This material may not be communicated to persons in jurisdictions where it would constitute a recommendation, an offer of products or services or a solicitation and where its communication would therefore contravene applicable legal and regulatory provisions. This material has not been reviewed or approved by any regulator in any jurisdiction. The figures, comments, opinions and/or analyses contained in this document reflect the Edmond de Rothschild Group's view of market trends based on its expertise, economic analyses and the information in its possession at the date of preparation of this document and may change at any time without notice. They may no longer be accurate or relevant at the time of publication, particularly in view of the date of preparation of this document or due to market developments. This document is intended solely to provide general and preliminary information to those who consult it and should not be used as a basis for any investment, disinvestment or holding decision. The Edmond de Rothschild Group shall not be held liable for any investment, disinvestment or holding decision taken on the basis of such comments and analyses. The Edmond de Rothschild Group therefore recommends that all investors obtain the various regulatory descriptions of each financial product before investing, in order to analyse the associated risks and form their own opinion independently of the Edmond de Rothschild Group. It is recommended to obtain independent advice from specialised professionals before entering into any transaction based on the information contained in this document, in order to ensure that the investment is suitable for the investor's financial and tax situation.

Past performance and volatility are not indicative of future performance and volatility and are not constant over time and may be independently affected by changes in exchange rates.

Source of information: unless otherwise indicated, the sources used in this document are those of the Edmond de Rothschild Group. This document and its contents may not be reproduced or used in whole or in part without the permission of the Edmond de Rothschild Group.

Copyright © Edmond de Rothschild Group - All rights reserved.

EDMOND DE ROTHSCHILD ASSET MANAGEMENT (FRANCE), 47, rue du Faubourg Saint-Honoré 75401 Paris Cedex 08, Société anonyme governed by an executive board and a supervisory board with capital of 11.033.769 euros, AMF Registration number GP 04000015, 332.652.536 R.C.S. Paris.