The shock waves from the Middle East have seriously destabilised the region. The Israeli government is facing various challenges: it has to ensure the country’s security and restore its military credibility and power of deterrence. But its riposte will have serious consequences on the entire region and, if the conflict intensifies, the macroeconomic and financial impacts could disrupt economies in the West.

As Hamas and Hezbollah are armed, trained and funded by Iran, there is more chance of an escalation. To stop a flare-up in the region, the US rapidly reinforced its military presence by sending two aircraft carriers.

The Middle East Realpolitik is particularly complex but we have tried here to anticipate the most probable scenarios and the likely impact on financial markets.

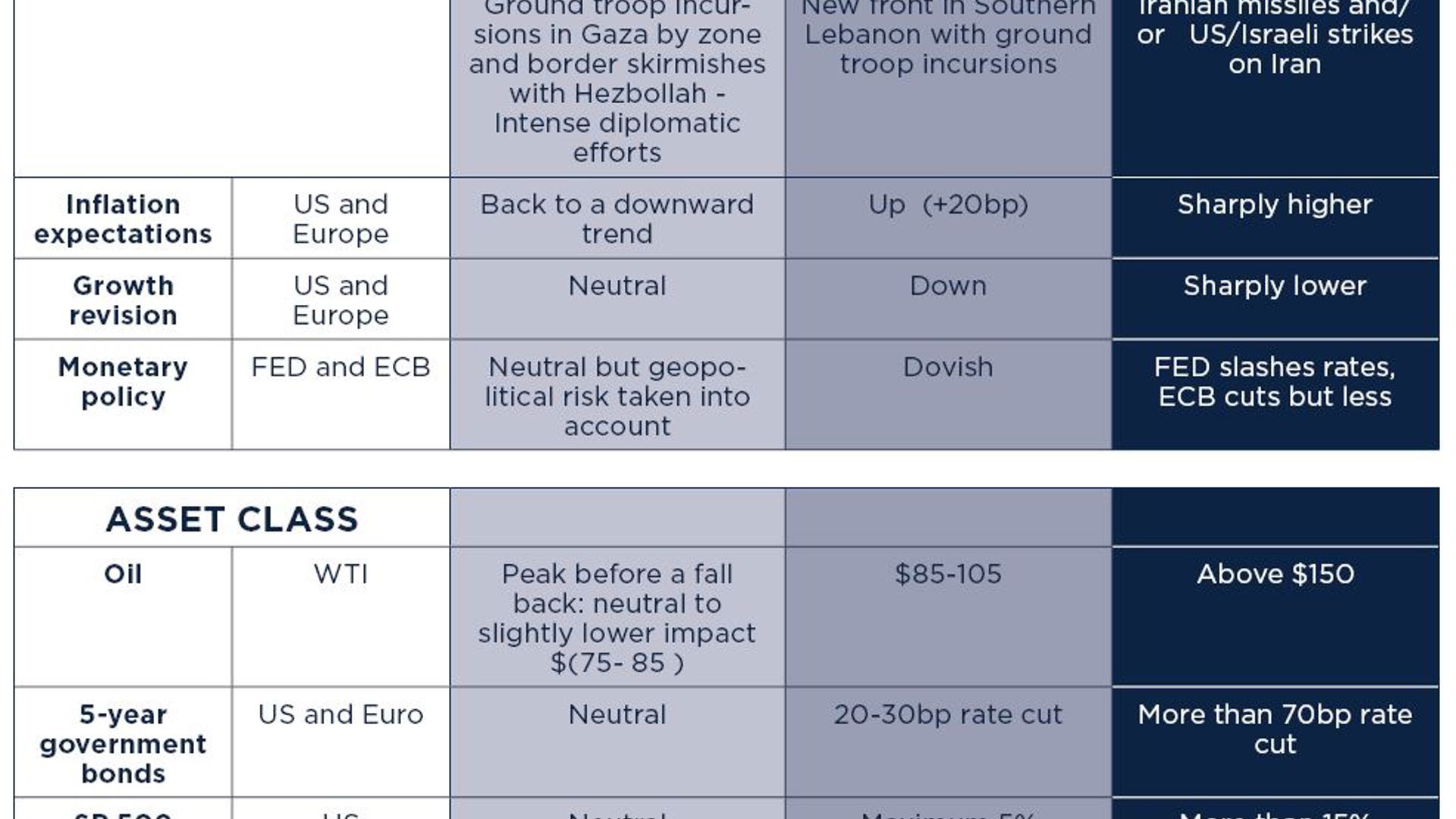

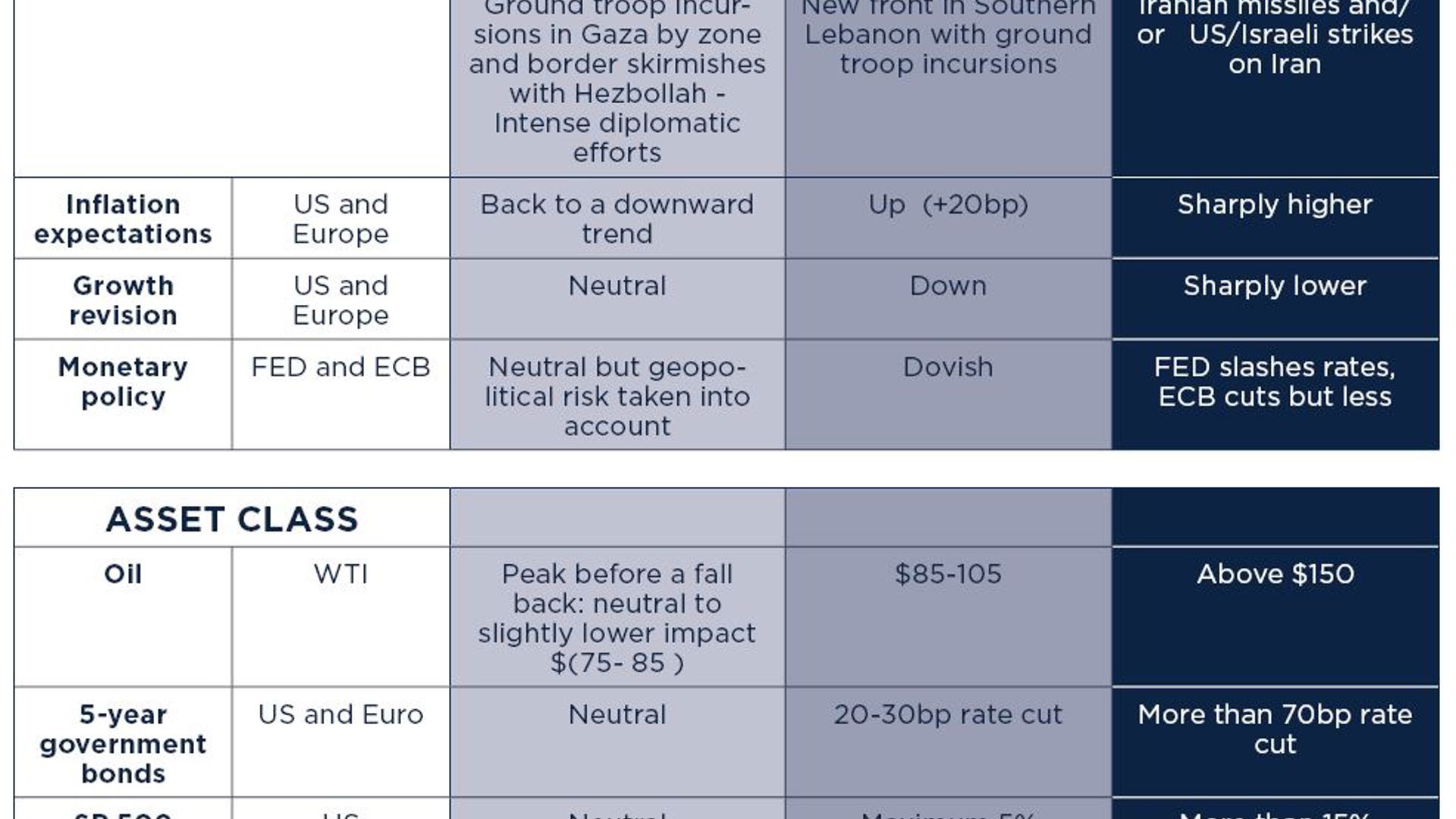

First scenario: a long but localised conflict (65% probability)

The conflict lasts several months despite international calls for a cease fire. Israel continues to bombard Gaza with, sooner or later, ground force incursions, mainly in the northern part of the strip.

The conflict with Hezbollah stays mainly on the Lebanese border with both sides sporadically firing rockets or missiles.

Foreign diplomats work hard to end the war and manage to stop an escalation.

After a few months, Hamas is replaced by another political and police force, perhaps Fatah, Egypt or a coalition of Arab countries. Israel might transform part of the strip into a no-go zone.

In this scenario, the world gets used to the situation and there is little impact on markets. Risk premiums rapidly contract and oil falls from peak levels to between $75-85 as the zone is not a commodity producer. Macroeconomics returns to its role as market catalyst. There would only be a small impact on monetary policy even if central banks claim to be taking geopolitical risk on board in monetary committee discussions (Fed chair Jerome Powell did so after the last FOMC).

Second scenario: a much bigger regional escalation (30% probability)

The conflict spreads with a new front opening up between Israel and Lebanon’s Hezbollah, a militia with around 100,000 heavily armed and well-trained fighters. The struggle could be particularly fatal and the outcome uncertain. If Hezbollah were to deploy its arsenal of 150,000 missiles, the US could intervene with targeted strikes.

As Lebanon and Israel have no strategic depth, it is difficult to imagine troops staying there for long.

This scenario is fraught with uncertainty and would mean fresh volatility. Oil would trade between $85-105.

Central banks would react to geopolitical uncertainty by turning dovish, making short-dated bonds attractive.

We could see a rerun of the March 2022 situation when Houthi rebels organised a drone attack on Saudi oil wells.

Third scenario: the conflict spreads (5% probability)

It would be surprising to see Iran getting directly involved in the conflict rather than going through its proxies Hezbollah and Hamas. We see no political advantage for Tehran to do so at the moment. And any US and/or Israeli strikes on Iran’s sensitive sites would risk destabilising the entire region.

We believe this scenario is unlikely but markets could nonetheless fail to rule it out completely if our second scenario plays out.

There would be a serious risk of conflagration with a possible collapse of Arab Sunnite regimes like Egypt or Jordan.

Depending on the extent to which the US gets involved in the conflict, China could seize the opportunity to get tougher with Taiwan before its elections in early 2024.

So far, such a scenario is highly unlikely but risk assets would be seriously hit and investors would rush into safe havens like 2-5 year maturities.

By Michaël Nizard, Head of Multi-Asset & Overlay and Laurent Benaroche, Fund Manager Multi-Asset & Overlay.

LEGAL DISCLAIMER: Written on 26/10/2023. This document is issued by Edmond de Rothschild Asset Management (France).

This document is non-binding and its content is exclusively for information purpose. Any reproduction, disclosure or dissemination of this material in whole or in part without prior consent from the Edmond de Rothschild Group is strictly prohibited.

The information provided in this document should not be considered as an offer, an inducement, or solicitation to deal, by anyone in any jurisdiction where it would be unlawful or where the person providing it is not qualified to do so. It is not intended to constitute, and should not be construed as investment, legal, or tax advice, nor as a recommendation to buy, sell or continue to hold any investment. EdRAM shall incur no liability for any investment decisions based on this document. This document has not been reviewed or approved by any regulator in any jurisdiction. The figures, comments, forward looking statements and elements provided in this document reflect the opinion of EdRAM on market trends based on economic data and information available as of today. They may no longer be relevant when investors read this document. In addition, EdRAM shall assume no liability for the quality or accuracy of information / economic data provided by third parties. Past performance and past volatility are not reliable indicators for future performance and future volatility. Performance may vary over time and be independently affected by, inter alia, changes in exchange rates. « Edmond de Rothschild Asset Management » or « EdRAM » refers to the Asset Management division of the Edmond de Rothschild Group. In addition, it is the commercial name of the asset management entities of the Edmond de Rothschild Group.

Edmond de Rothschild Asset Management (France)

47, rue du Faubourg Saint-Honoré, 75401 Paris Cedex 08

Société anonyme governed by an executive board and a supervisory board with capital of €11,033,769 -

AMF registration No. GP 04000015 - 332.652.536 R.C.S Paris