Benjamin Melman, Global Chief Investment Officer, Asset Management.

The spotlight is still trained on central banks

With disinflation picking up speed and pending a return to normal conditions, central bank moves will still play a big part in overall market momentum. That will obviously be the case for fixed income but also for equity markets: interest rates represent the biggest risk for equity markets (contracting in bank loans, deleveraging in Europe and the US), as well as for company margins (rising financial charges) and for valuations. Disinflation is continuing as expected and investors want central banks to return to normal monetary policy. Fixed income and equity returns could be significant in 2024 even if there are several reasons why earnings could disappoint. Monetary normalisation could mean significant easing in benchmark rates to close to half current levels. So investors need to heed what Jerome Powell and Christine Lagarde say when discussing the timing of the first cut at their press conferences, even if official communiques maintain a neutral bias.

US growth is still defying gravity

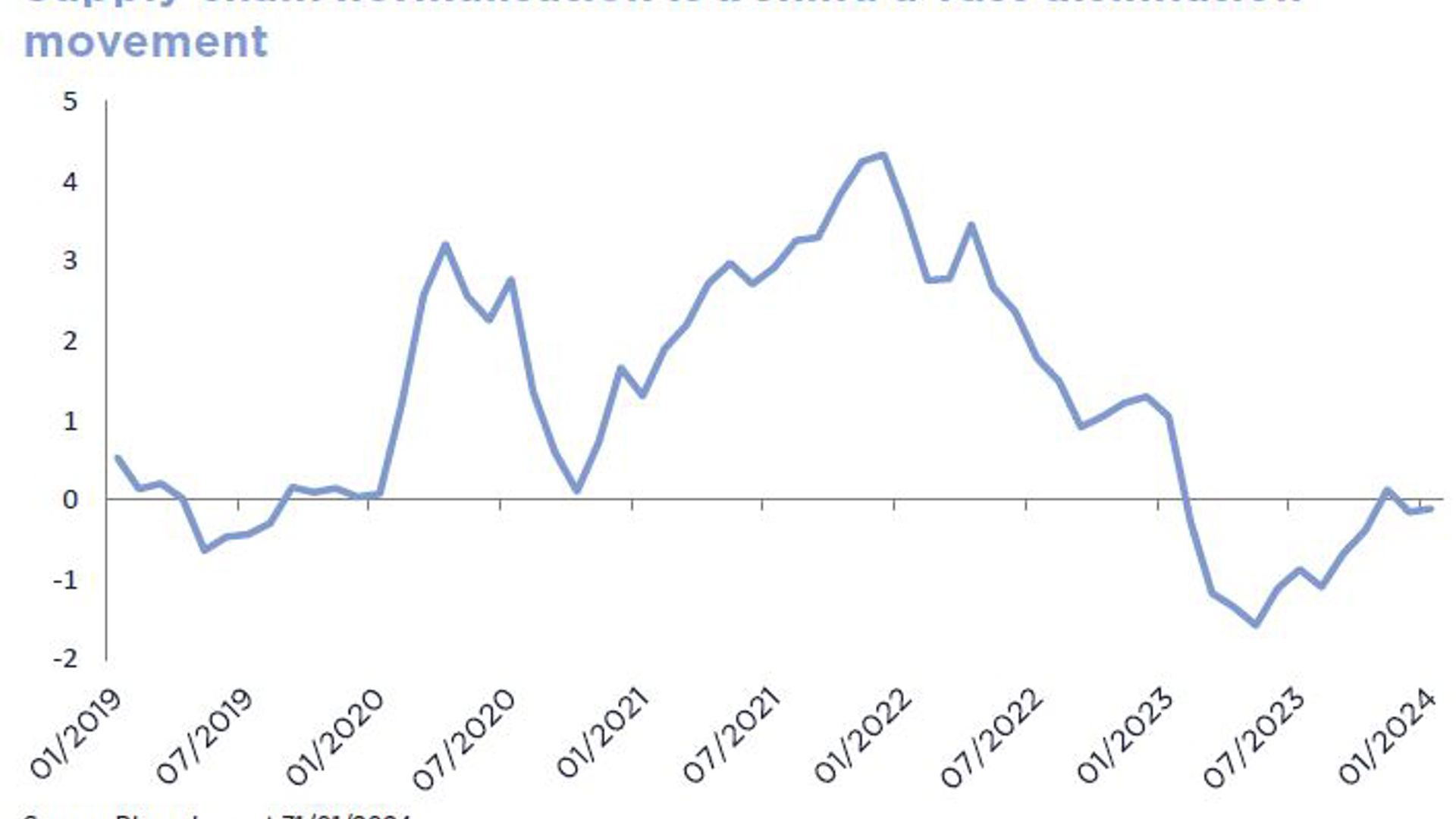

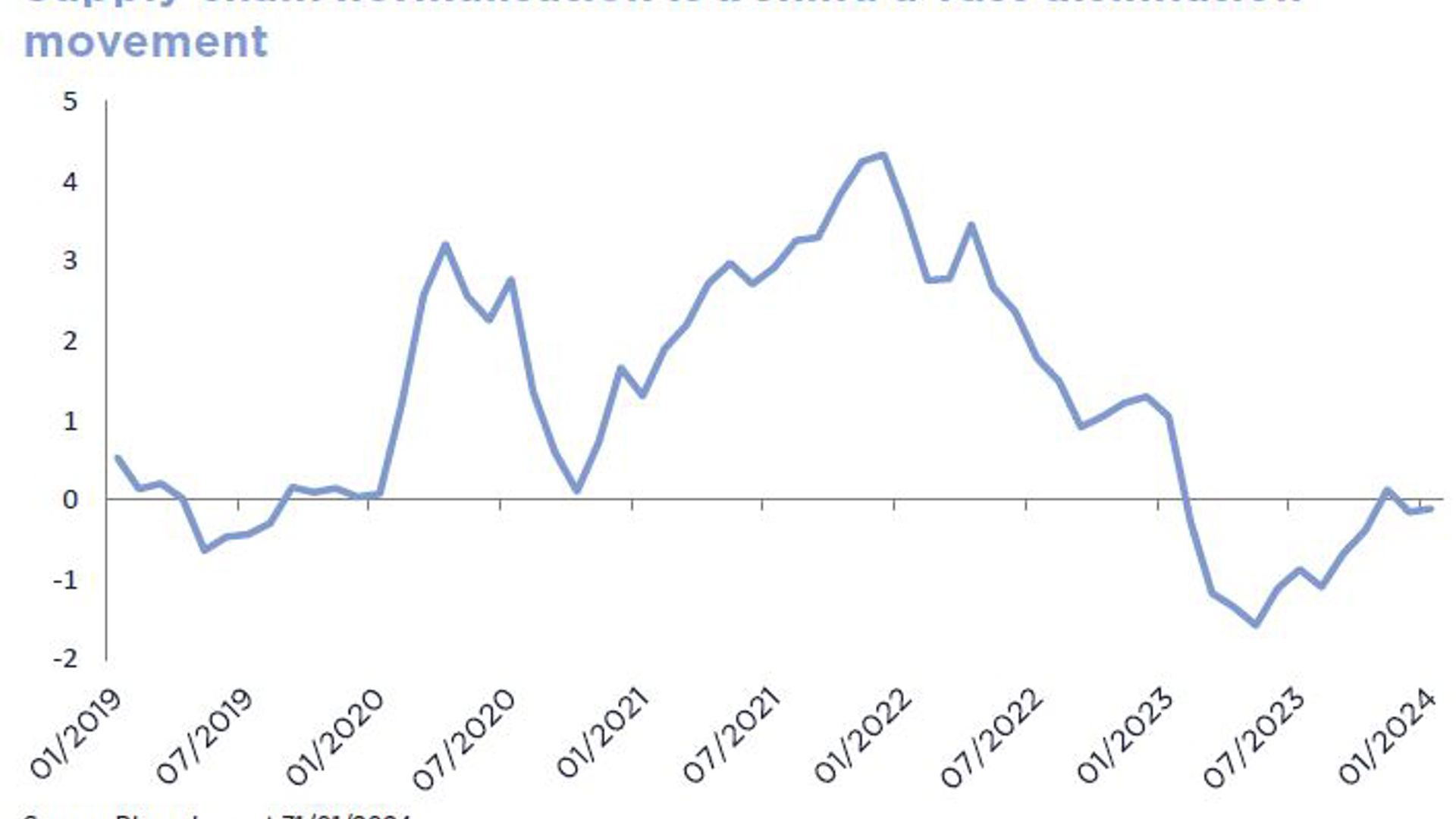

Central banks have corroborated several surveys which show how essential supply chain normalisation has been in getting inflation lower. But it is, however, difficult to see how long this will continue now that production has returned to normal. Faced with this uncertainty, an incipient slowdown in such strong growth would be preferable. There was no sign of this in the fourth quarter of 2023 or in January. Several indicators even suggest an unexpected re acceleration is at play. Disinflation has been fuelled by increased supply rather than falling demand so there is no doubt that a large part of this resilience is due to renewed purchasing power. Core PCE1 has fallen to an annualised 1.9% over the last 6 months, a fall of over 2% compared to the previous six months. For consumers, that represents a big move. But as most disinflation is now over, this growth driver is about to disappear. In addition, fiscal policy will turn more neutral this year after significantly underpinning growth in 2023. As a result, we think a US slowdown is inevitable; we just have to be patient.

Europe’s economy is stabilising at last!

The ECB’s Bank Lending Survey points to a recovery in financial conditions from low levels. Fewer banks now want to tighten lending conditions and the number of them expecting a drop in loan demand is also down. The latest bank lending data suggest the situation is beginning to improve. And PMI surveys have also recovered a little. There is still no reason to hope for a recovery in Europe but investor pessimism on the zone was probably overdone.

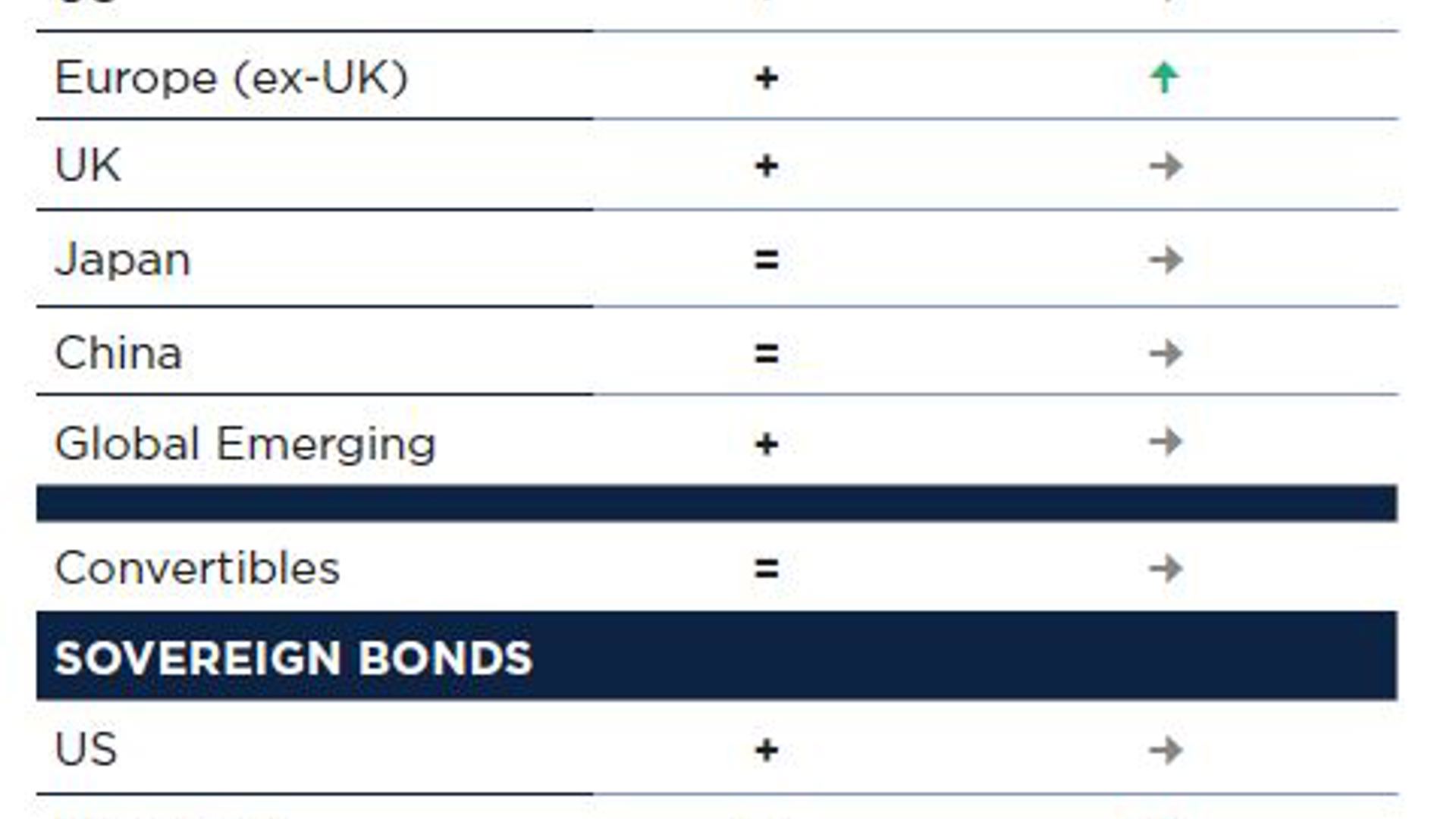

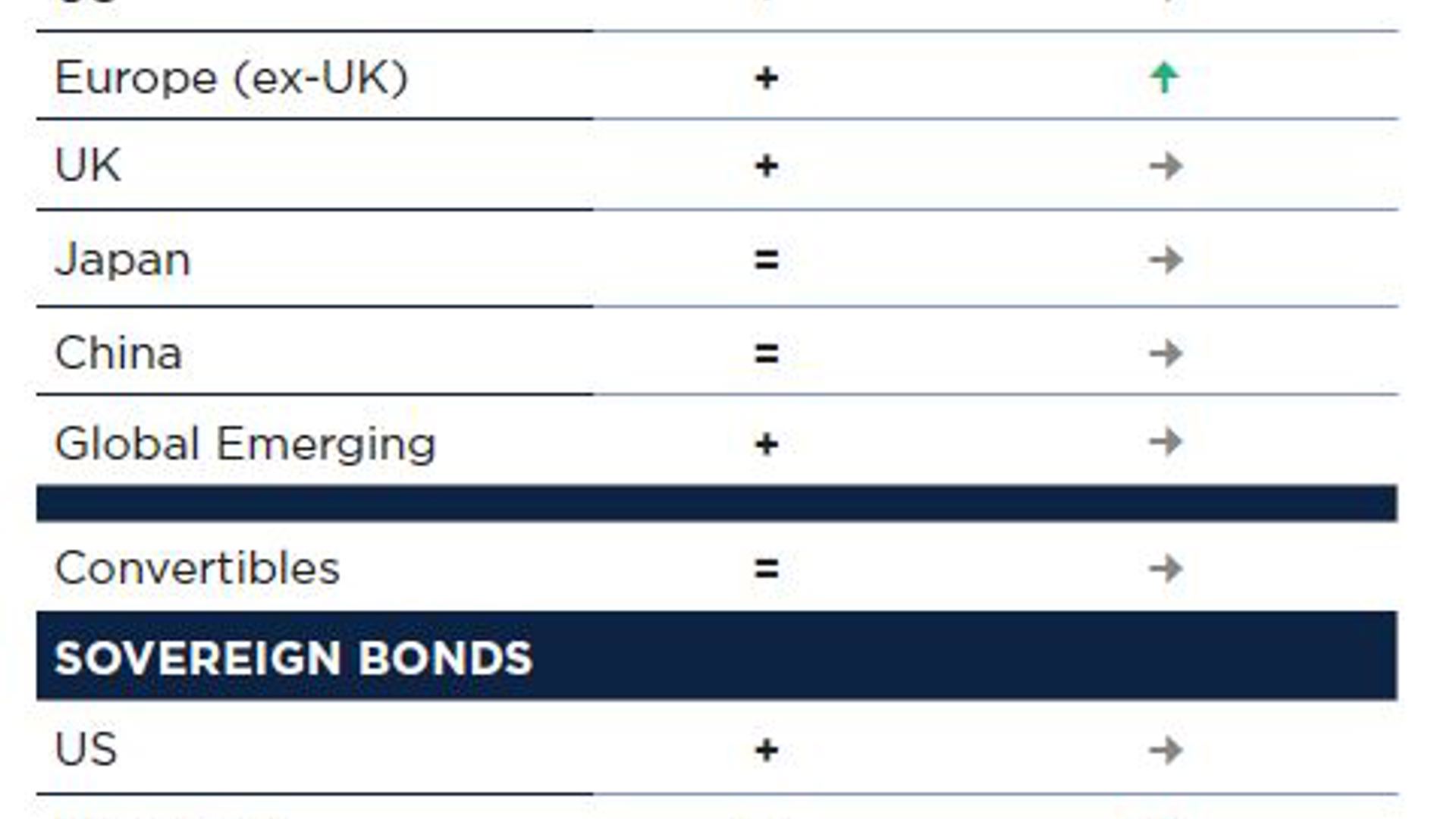

No change to our overall asset allocation but tactical adjustments

We remain overweight bonds and are neutral on equity markets but we have reinforced European bonds and equities at the expense of other assets and for the following reasons: (i) not only are investors too pessimistic over Europe but European equities stand to gain should a surprising global recovery occur and, (ii) the US economy's resilience may pose a problem for the Fed over when and by how much to cut rates but the ECB is free to act as Europe's economy has stabilised at the bottom.

1. PCE: Personal Consumption Expenditures. This refers to household consumption excluding volatile items. This indicator measures price variations from the consumer's point of view. It is a key tool for measuring changes in purchasing trends and inflation.

Key points

- Central bank strategies continue to play a major role in market dynamics

- We remain overweight bonds and neutral on equity markets

- We have reinforced European bonds and equities at the expense of other assets

Legal disclaimer: Written on February 7th 2024. This document is issued by Edmond de Rothschild Asset Management (France). This document is non-binding and its content is exclusively for information purpose. Any reproduction, disclosure or dissemination of this material in whole or in part without prior consent from the Edmond de Rothschild Group is strictly prohibited. The information provided in this document should not be considered as an offer, an inducement, or solicitation to deal, by anyone in any jurisdiction where it would be unlawful or where the person providing it is not qualified to do so. It is not intended to constitute, and should not be construed as investment, legal, or tax advice, nor as a recommendation to buy, sell or continue to hold any investment. EdRAM shall incur no liability for any investment decisions based on this document. This document has not been reviewed or approved by any regulator in any jurisdiction. The figures, comments, forward looking statements and elements provided in this document reflect the opinion of EdRAM on market trends based on economic data and information available as of today. They may no longer be relevant when investors read this document. In addition, EdRAM shall assume no liability for the quality or accuracy of information / economic data provided by third parties. Past performance and past volatility are not reliable indicators for future performance and future volatility. Performance may vary over time and be independently affected by, inter alia, changes in exchange rates. « Edmond de Rothschild Asset Management » or « EdRAM » refers to the Asset Management division of the Edmond de Rothschild Group. In addition, it is the commercial name of the asset management entities of the Edmond de Rothschild Group.

Edmond de Rothschild Asset Management (France)

47, rue du Faubourg Saint-Honoré, 75401 Paris Cedex 08

Société anonyme governed by an executive board and a supervisory board with capital of €11,033,769 -

AMF registration No. GP 04000015 - 332.652.536 R.C.S Paris