Yield curve inversion has been around for almost two years, Europe is the theatre of a serious war, China is mired in deflation, globalisation is still stuck in a US-China trade conflict, rampant inflation has given way to a monetary shock and yet, even without a recession, risk assets have soared in today’s Goldilocks1 environment. Who could seriously have seen this coming? The latest news is clearly upbeat: data suggest European recession risk has abated and there are even signs of an improvement in China. True, the recent rebound in inflation in the US has rekindled some worries but not enough to deter the Fed and ECB from letting investors expect a rate cut, exactly the message that markets wanted to hear.

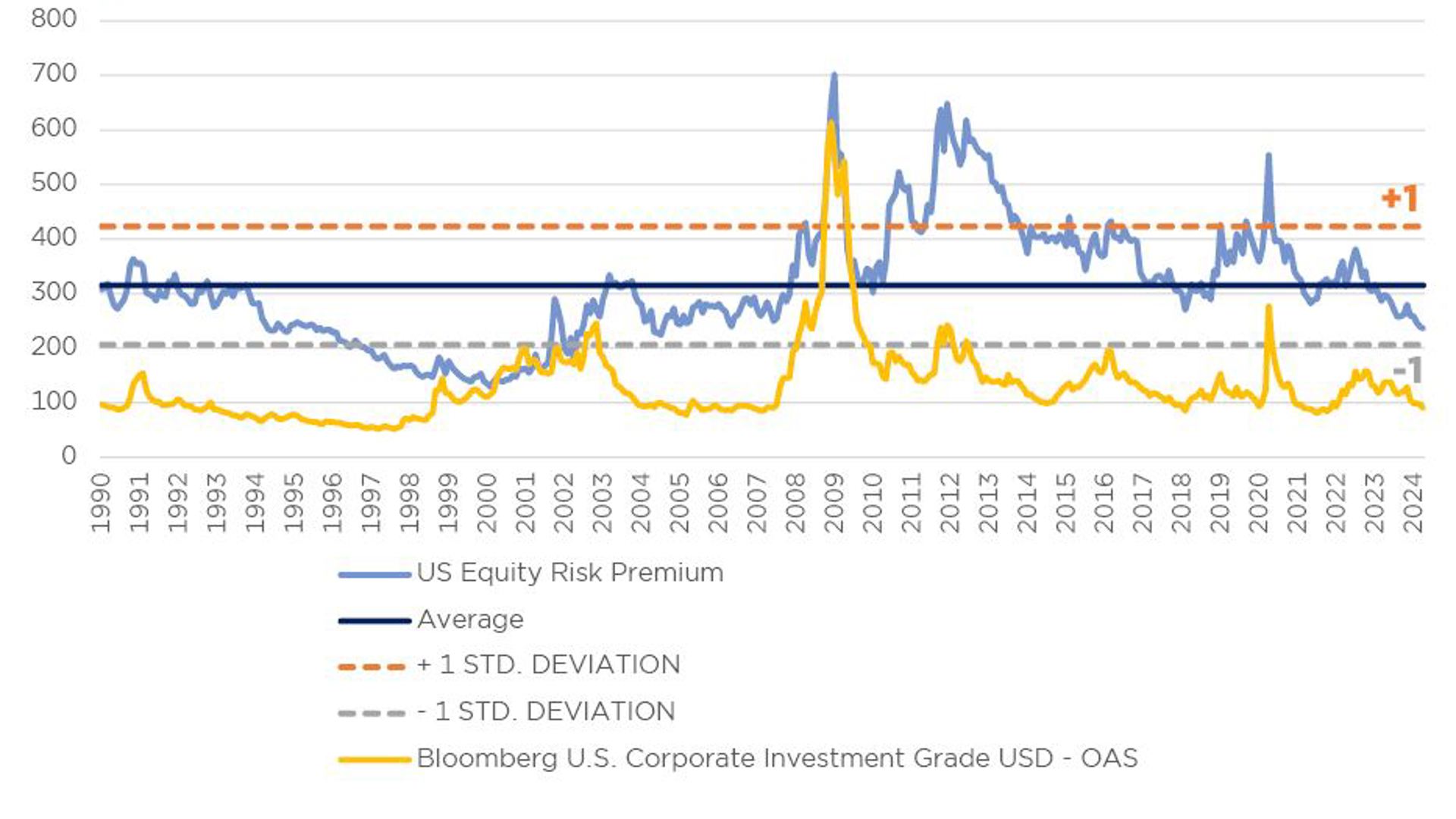

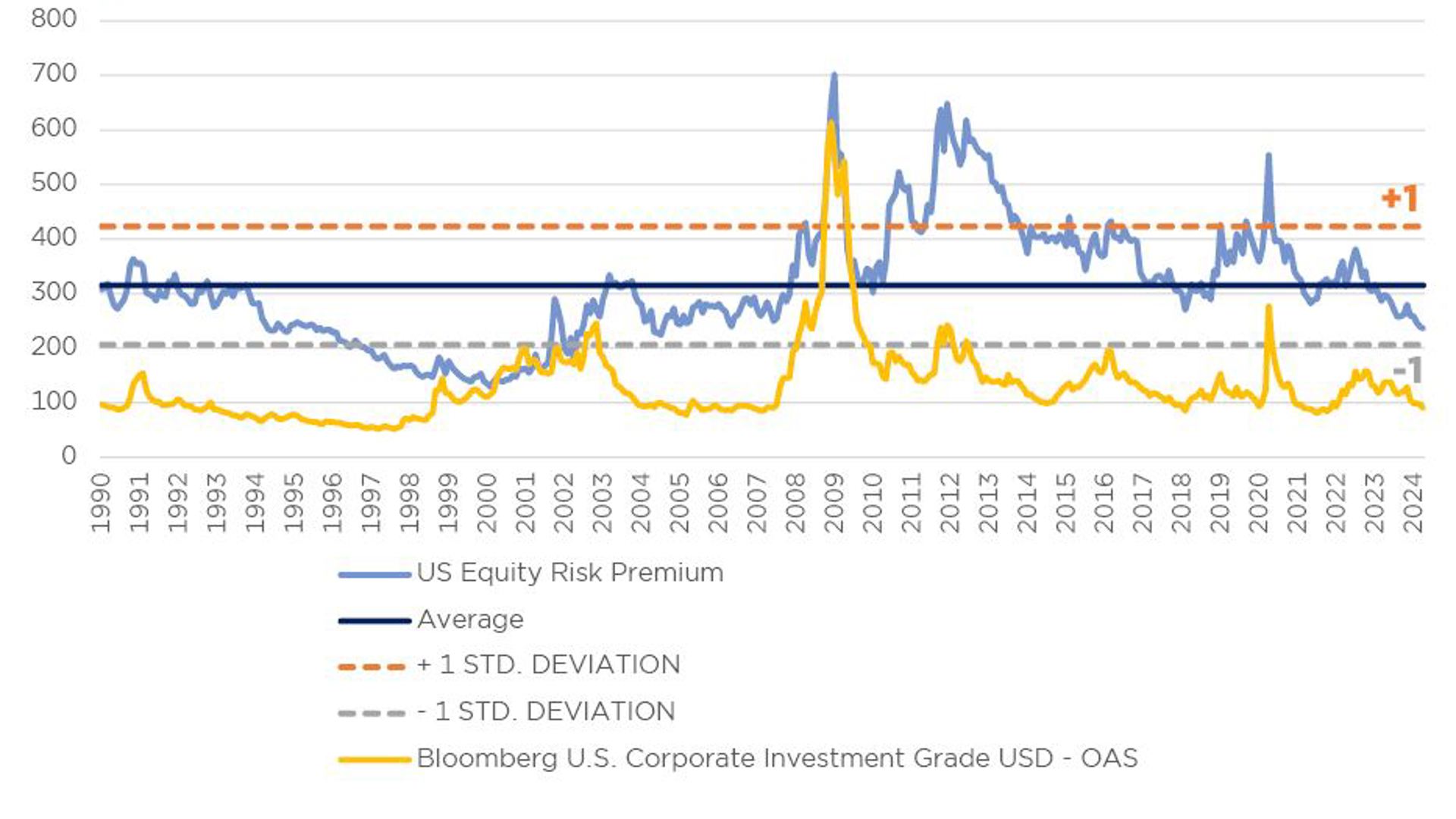

This magic paradigm was only recently considered an improbable scenario but now seems unshakeable. So much so that surveys indicate buoyant investor optimism with some strong equity positioning. And as a result, risk asset valuations are now looking stretched.

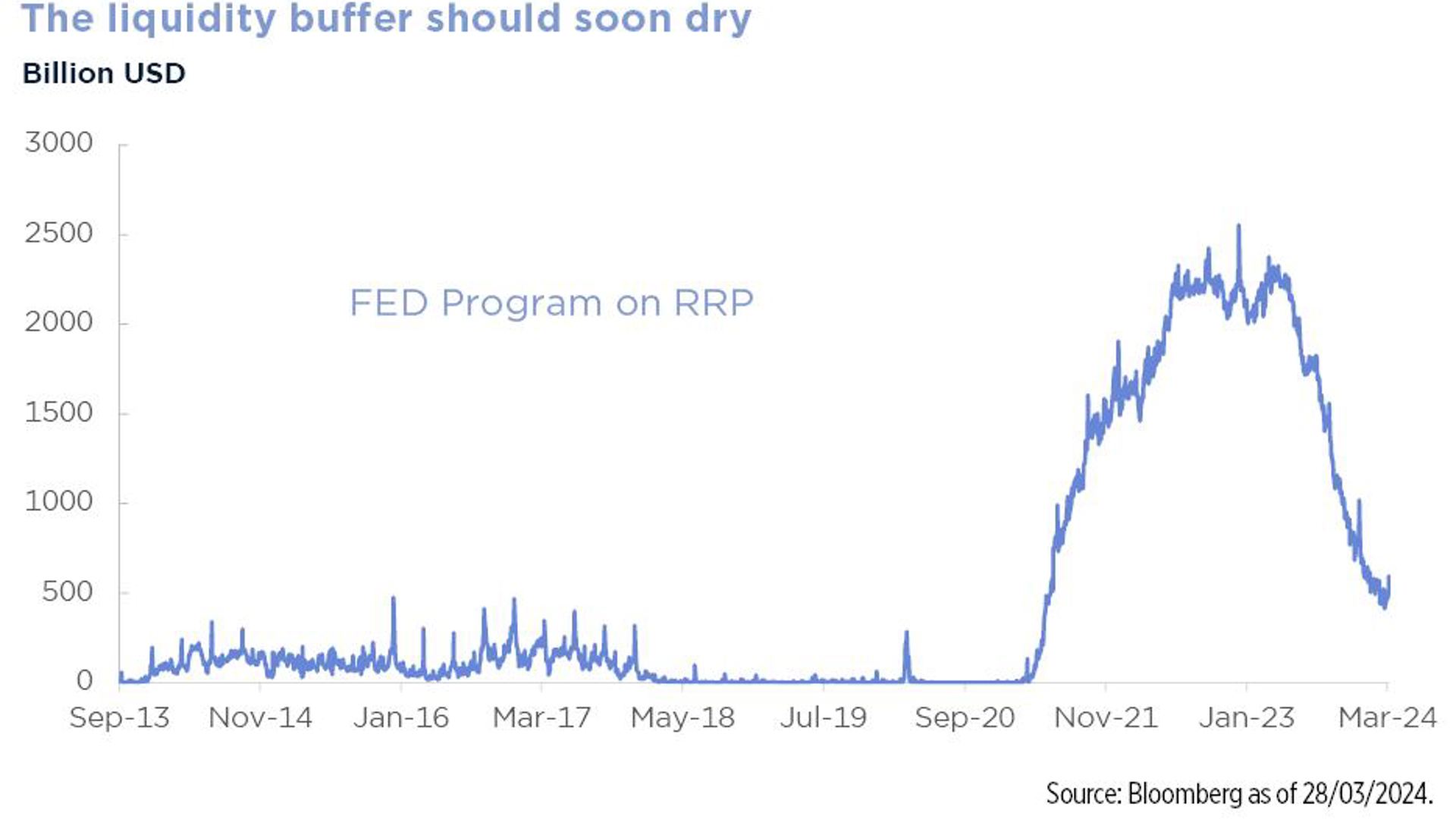

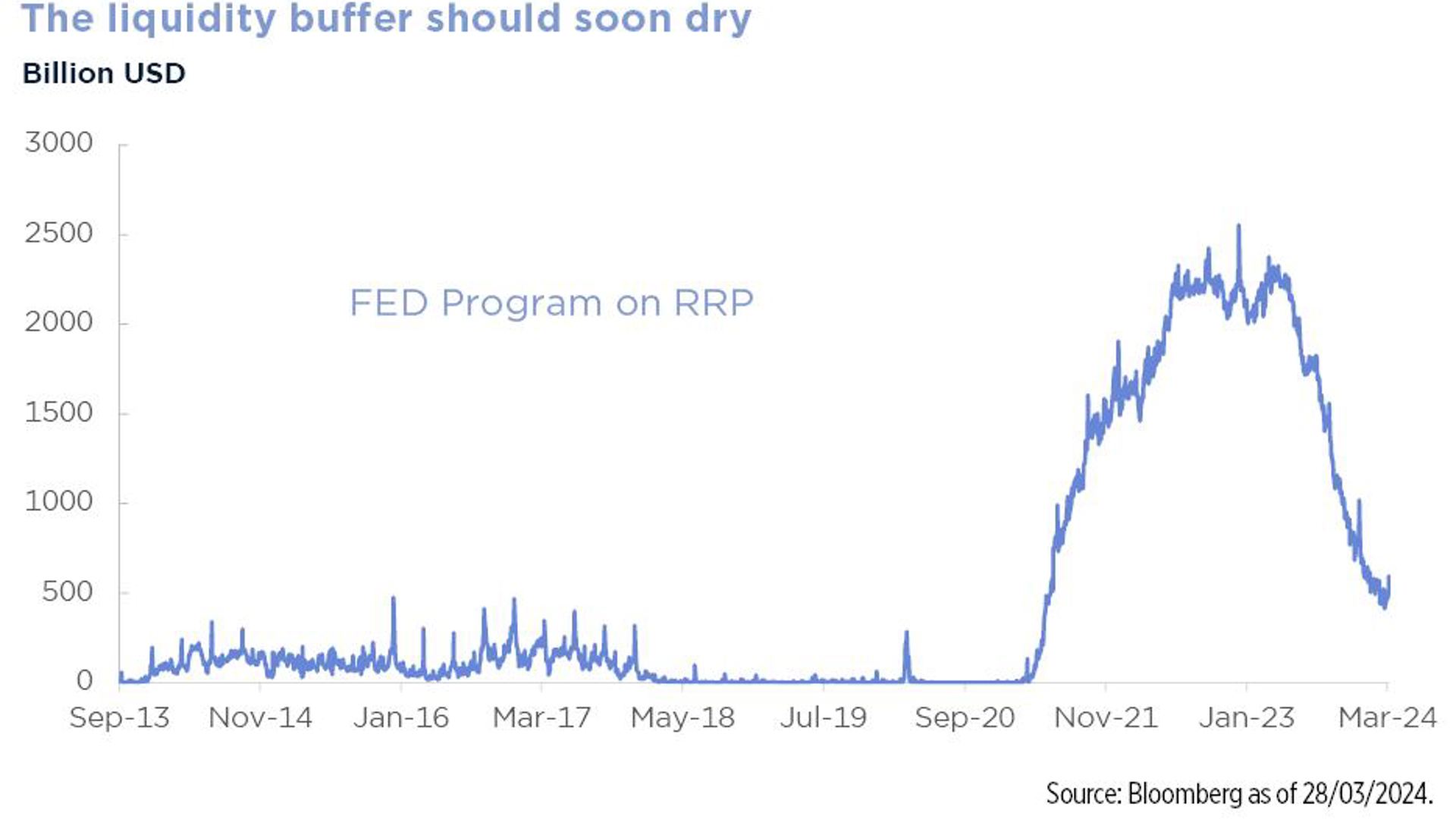

Another point worth noting is that in spite of quantitative tightening2, liquidity has improved in the US (as indicated in commercial bank reserves held with the Fed). This is thanks to massive shifts out of the monetary funds which had been parked in the Fed’s Reverse Repo programme over the last 3 years. The programme is almost at an end so this improvement will not last. As evidenced in the graph alongside, liquidity helped drive the market rebound but we will soon no longer be able to count on this.

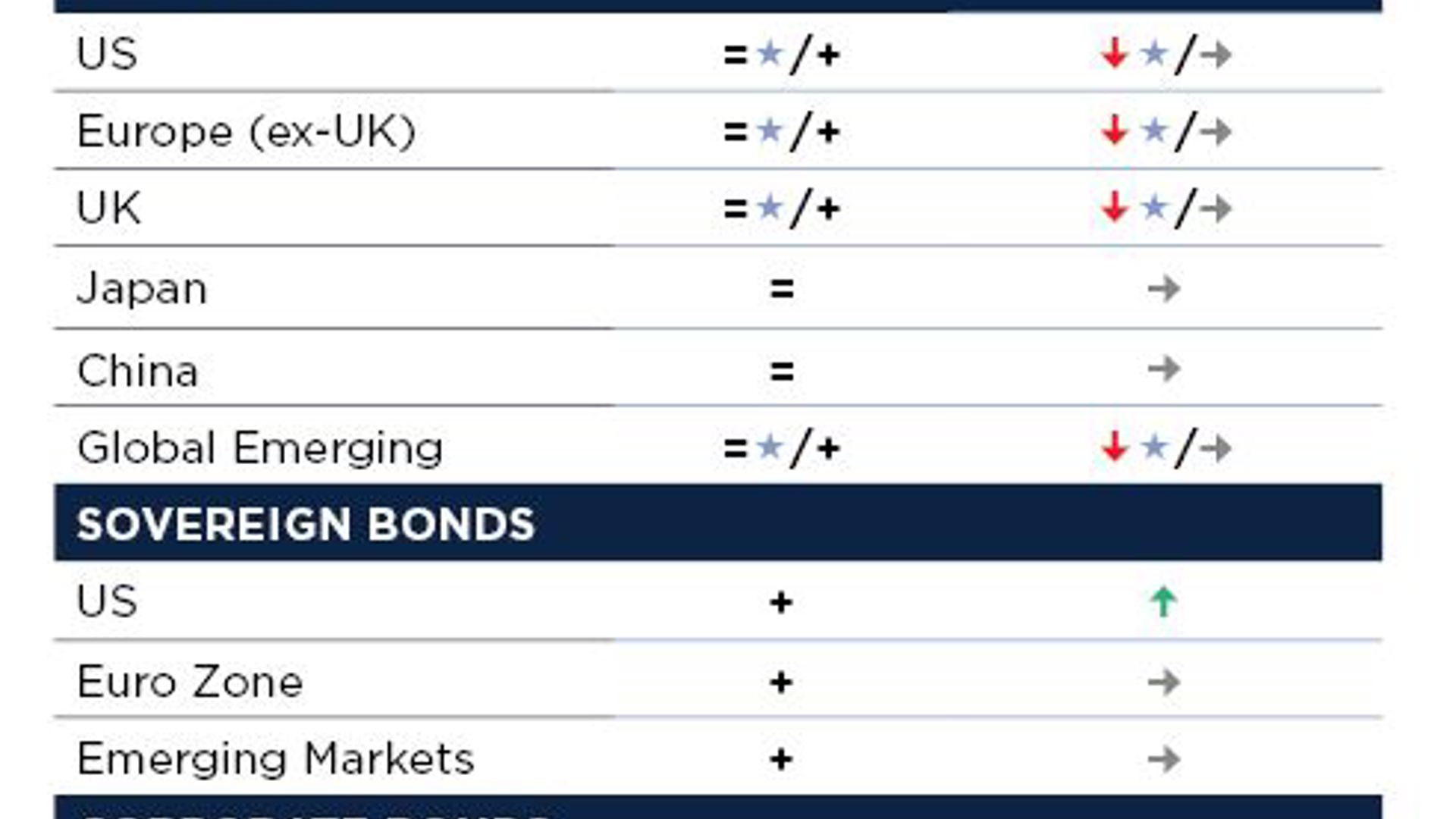

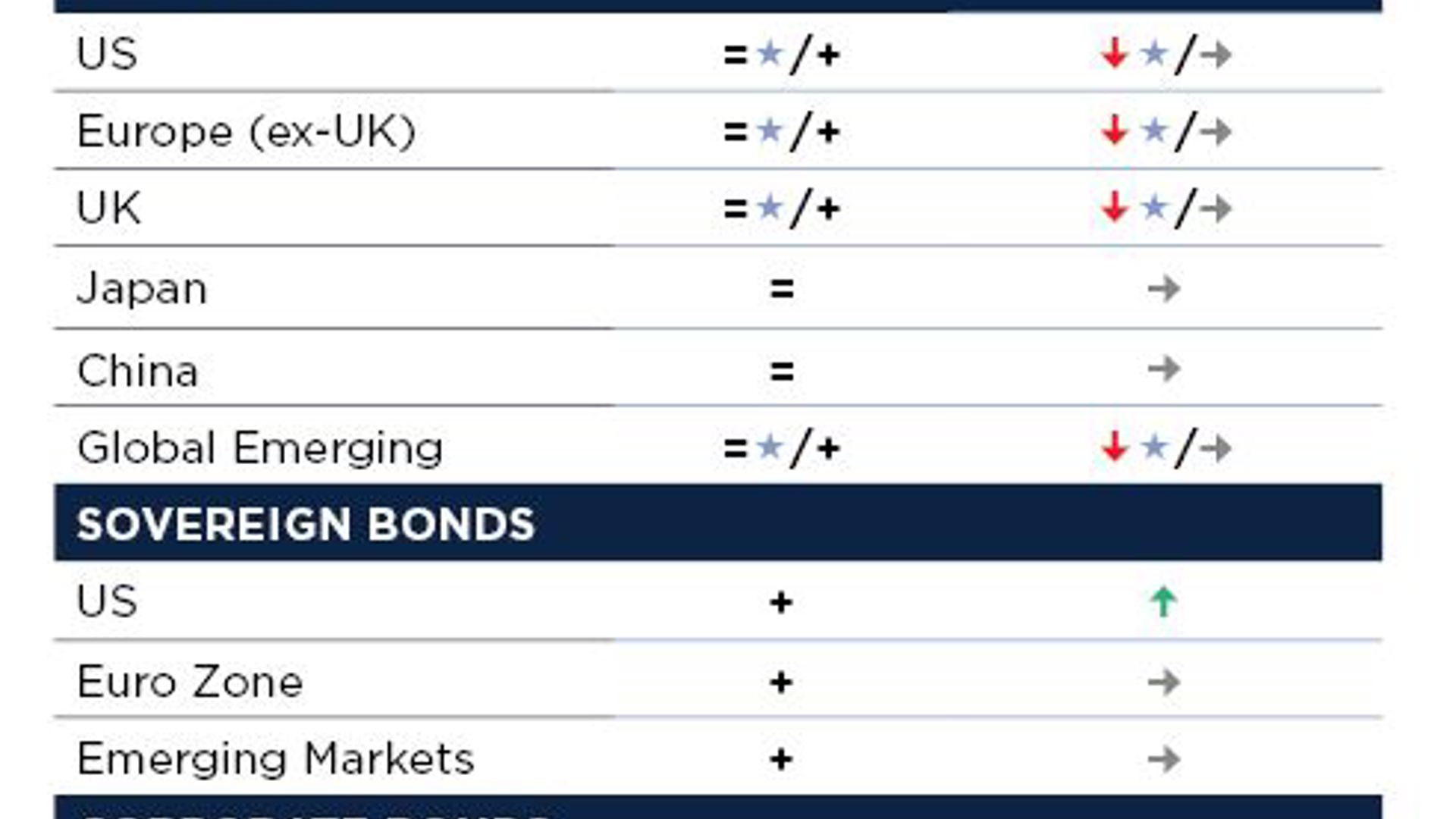

In other words, we are now embarking on a phase where past performance really is no indication of future returns. There are now fragile points in the market which could result in significant shifts if surprises occur. And surprises have been plentiful in recent quarters: we continue to fear the eventual impact of (i) higher financial charges on companies and (ii) ongoing private sector deleveraging in western economies. Finally, should US inflation continue to surprise on the upside, equity markets counting on a monetary easing cycle by the Federal Reserve could start to doubt. Even if March's rally was more broad-based, rather than being concentrated on a handful of megacaps, we prefer to act preventively by trimming our overall equity exposure.

We now have no specific geographical bias. However, we continue to like big data, healthcare and small caps. Valuations in the small cap universe are still attractive. Small caps have significant catch-up potential if the economy stabilises or recovers, if banks loosen lending conditions (as surveys suggest they might) or if central banks actually cut rates. Finally, the Value segment in the US could rebound if the more reflationary than expected environment is confirmed.

There are also opportunities on bond markets despite tighter spreads. To start with, rates are now high in absolute terms so they offer some protection against any economic accident; lower rates would offset any spread widening. And then, subordinated financial debt is relatively more appealing than corporate bonds so there are still opportunities there. Lastly, we are overweight emerging country bonds as they should benefit from the looming Fed rate-cut cycle and China’s economic recovery.

1 “Goldilocks” when applied to economies means “not too hot or too cold but just right”. It indicates moderate and stable growth with the right balance between growth and inflation, so no excessive moves higher or severe contractions.

2 Le quantitative tightening (resserrement quantitatif) est un outil de politique monétaire restrictive appliqué par les banques centrales pour réduire la quantité de liquidités ou la masse monétaire dans l'économie.

Key points

- Today’s magic paradigm seems unshakeable.

- Liquidity helped drive the market rebound but we will soon no longer be able to count on this.

- We now have no specific geographical bias but we continue to like big data, healthcare and small caps.

- There are also opportunities on bond markets despite tighter spreads.